The official unemployment rate in January was 9% and the total number of unemployed persons were at 13.9 million according to BLS data. As of Feb 17th, 2011 the total U.S. debt held by the public is 9,490,705,812,100.38. Foreigners held about $4.4 Trillion of U.S. treasury securities at the end of 2010. The U.S. spends billions of dollars in interest payments to service all this debt.

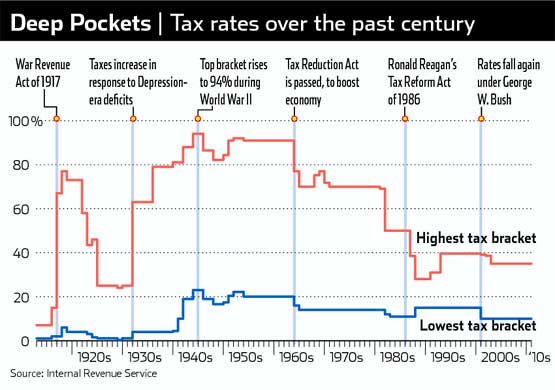

Despite the rise in prices of assets like equities in recent months, the U.S. economy continues to be in doldrums. The employment rare continues to remain stubbornly high in spite of record profits earned by corporations.In this context it a good idea to take a look at the current U.S. income tax system. The chart below shows the U.S. tax rate changes over the past century:

Source: The Wall Street Journal

The chart above shows that the tax rates for high earners in this country has been steadily declining since 1960s.During the Second World War the top tax bracket rose to 94%.But this rate stands at just 35% now for earned income over $379,150. The Federal lowest tax bracket stands at 10%.

Republicans would argue for further reduction of taxes saying that lower rates help stimulate the economy. Some democrats would argue for increasing taxes on the higher earners. The fact is that despite the fall in tax rates under the previous President George W.Bush the economy has not improved and the promised investments and job growth has not happened here. Instead companies have been creating jobs abroad and high earners have been reaping the rewards in terms of low taxes on capital gains, earned income and dividends. President Obama, a democrat, in another policy failure extended the Bush tax cuts again favoring the wealthy.

In general, the current U.S. tax regime is unfair, unsustainable and needs a complete overhaul. With the country involved in two wars, sky-high deficits and government spending poised to soar due to healthcare reforms, entitlement programs like social security, medicare, etc. it is time to raise the rates on the top tax bracket.The argument that lower tax rates for the wealthy stimulates economic growth no longer holds true.The current low tax rates and inflation in asset prices suits the wealthy perfectly well since they are able to multiply their wealth while the middle-class and the poor are forced to deal with rising gas, food, healthcare costs, etc. on top of the horrendous job market and collapse of the housing market. In addition, many states are cutting social services across the board as they are also suffering from budget issues due in part to reckless spending during the good times.