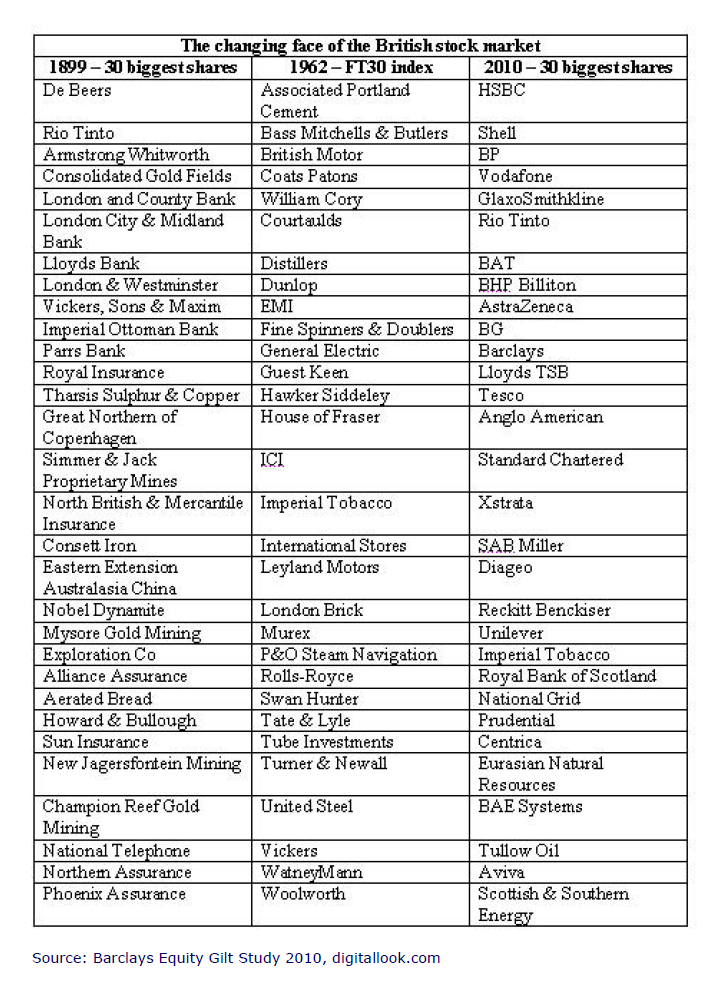

In an earlier post, we looked at the Historical Components of Dow Jones Industrial Average since 1896. The chart below shows the evolution of the British stock market since 1899:

Click to enlarge

Source: The Barclays Capital Equity Gilt Study

Reinvestment of dividends is an important tool to increase the total returns earned on an equity investment. The Barclays study confirms this theory again.

“With 110 years in its database now, Barclays calculates that £100 invested in the UK stock market in 1899 would have grown to £11,407 by the end of 2009 in terms of capital appreciation alone. If dividends from the shares had been reinvested, however, the same £100 would have grown to a scarcely believable £1.49m. ”

Companies from just four sectors that dominate the British equity market today. These sectors are mining, financials, oil and pharmaceuticals. Similarly in the early 1900s, the market had concentration in the finance and mining industries. In the first column of the above chart we see companies like Lloyds Bank(LYG), Royal Insurance, Northern assurance, etc. in the financial sector and many mining companies in that sector.

Disclosure: Long LYG