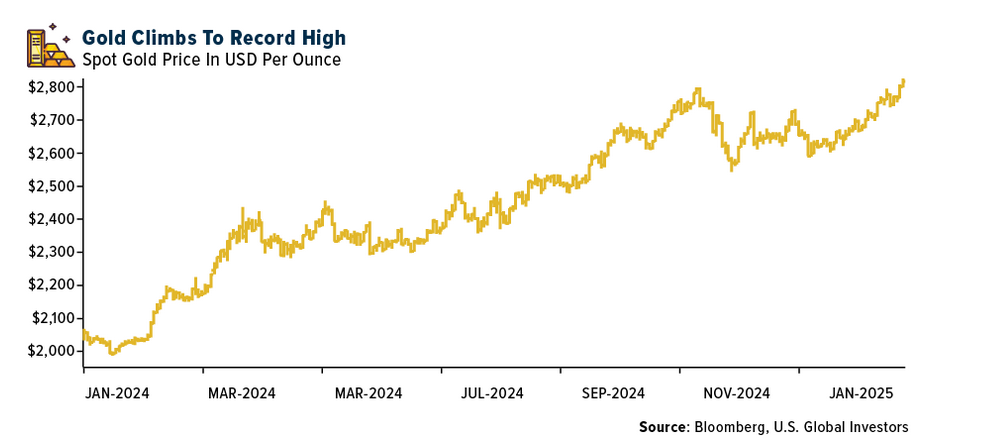

Gold prices surged 1.8% to close at $1,340.70 an ounce yesterday as investors sought the safety of the yellow metal. Despite the slight fall in gold prices so far this year, gold has had an incredible run in recent years.

An article in The Wall Street Journal takes a bearish view on gold suggesting that gold’s golden era may be over.

From the article:

How far could gold fall in the short term? Technical measures suggest that gold’s current price is close to its near-term “support” level—the price at which investors, attracted by a perceived bargain, are expected to rush in. If it falls below $1,320 and stays there, the next price where buyers would be expected to cluster would be near $1,280.

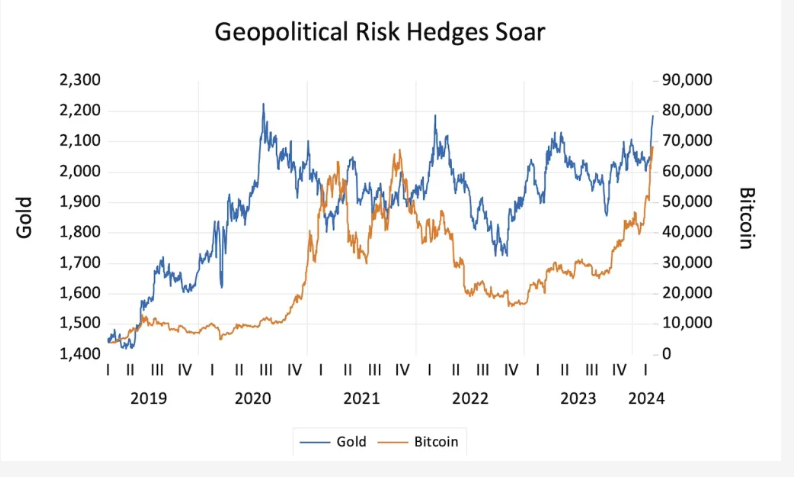

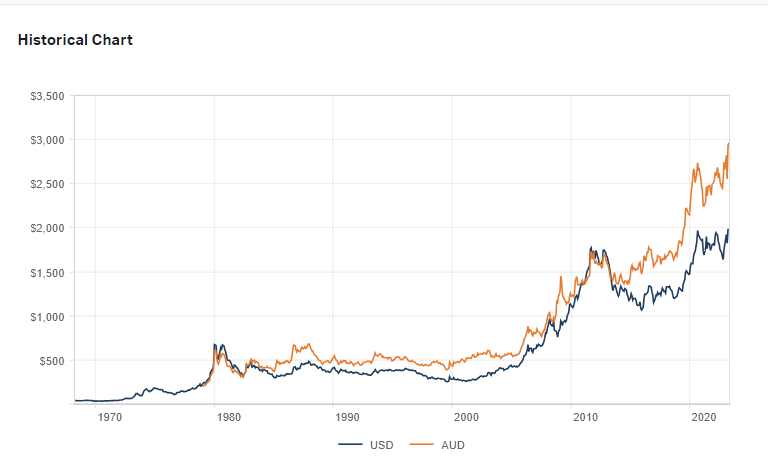

Over the longer term, too, the case for gold seems less compelling, say some analysts. While the metal has traditionally been seen as a buffer against runaway inflation and a collapsing dollar, at these prices gold may have less value as an insurance policy than investors might think.

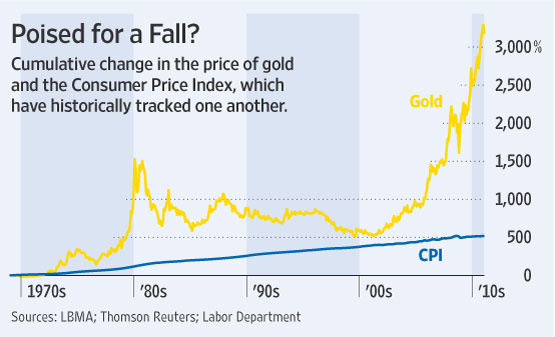

Take inflation. From 1968—when investors started to price in the possibility of the U.S. dropping the gold standard—to 2001, the price of gold rose 5.6% a year, while the Consumer Price Index gained 5.1% annually. That hasn’t been the case recently: Since 2001 gold has surged 18.8% annually, while the CPI has risen just 2.3%.

To restore their historical relationship, inflation would have to rise by 8.3% a year for the next 20 years to justify current prices. If inflation were to rise by its average since 1968 of 4.7%, gold would have to drop 3.6% a year for the next 20 years, according to Tim Courtney, chief investment officer at Burns Advisory Group. “This latest gold craze is way overdone,” he says.

It remains to be seen if gold prices would decline or gain further this year.