Dividends are an important component of total returns of equity investments. After going out of favor during the booming 90s dividend stocks are back in fashion now. Currently the S&P has a dividend yield of about 2%. The chart below shows the return on the S&P 500 by decades:

Click to enlarge

In the 1970s U.S. companies used to have higher dividend payouts. Hence during that time dividends accounted for 75% of the total return of the S&P 500. Since that time dividend payouts have fallen and during the 90s bull market, dividends contributed just 14% of the total return. However with stock prices remaining flat to slightly higher in the last decade the contribution of dividends to total return may be higher in this decade.

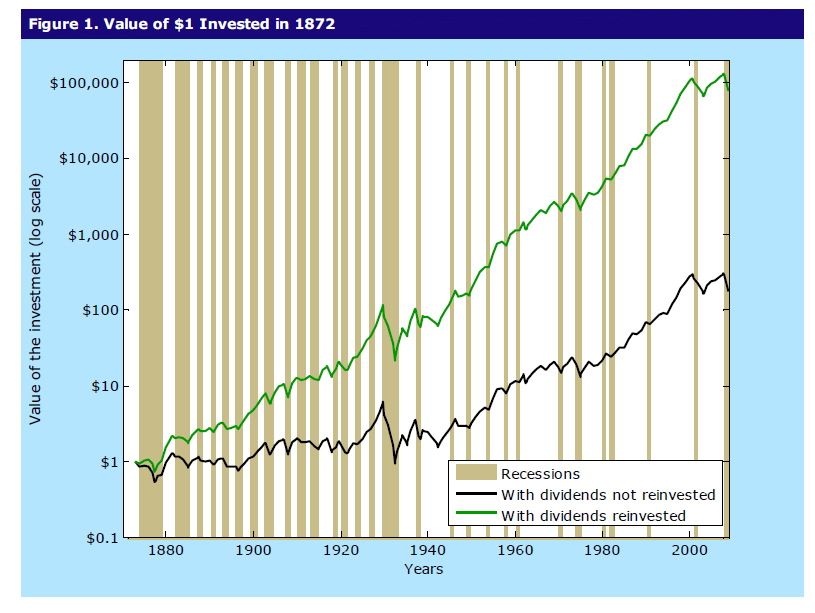

Using historical data, Yale university professor Robert Shiller has constructed a stock market index for larges companies. The index begins in December 1872 and ends in December 2008. This is an extension of the S&P 500 index.

The graph below shows the growth of $1 over time with dividends reinvested and not reinvested:

Source: Valuescope

The black line shows the growth of $1 that one invested in December 1872 and updated the portfolio regularly to reflect the composition of the S&P 500 with all dividends taken out during the 136-year period. The value in December 2008 would have been just $173. On the other hand, if one had reinvested all the dividends received each year during that long period, the $1 would have grown to an impressive $79,962 by December 2008 as shown by the green line.

Investors looking for long-term investment opportunities can explore some of the dividend aristocrats. A few of the large-cap, high-quality dividend stocks are shown below with their current yields:

1. 3M Co (MMM)

Country: USA

Current Dividend Yield: 2.42%

2. Johnson & Johnson (JNJ)

Country: USA

Current Dividend Yield: 3.45%

3. Kimberly Clark (KMB)

Country : USA

Current Dividend Yield: 4.26%

4. Abbot Laboratories (ABT)

Country: USA

Current Dividend Yield: 3.72%

5. ExxonMobil (XOM)

Country: USA

Current Dividend Yield: 2.47%

6. Unilever (UN)

Country: The Netherlands

Current Dividend Yield: 3.89%

7. Unilever plc (UL)

Country: UK

Current Dividend Yield: 3.97%

8. British American Tobacco (BTI)

Country: UK

Current Dividend Yield: 2.81%

9. Nestle (NSRGY)

Country: Switzerland

Current Dividend Yield: 2.43%

Among the Canadian stocks, Royal Bank of Canada (RY) is a consistent dividend payer and has also increased dividends over time. The current dividend yield for Royal Bank is 3.67%.

Disclosure: Long RY