The global automotive industry is one of the complex industries for investors to analyze and seek investment opportunities. This is because the industry is subject to various forces that are unique to the industry such as political protectionism, fierce competition, labor issues, etc. In addition, earnings are highly cyclical and returns decline over time. In this post let us take us a quick of some of the major issues related to this industry based on a research report by AllianceBernstein.

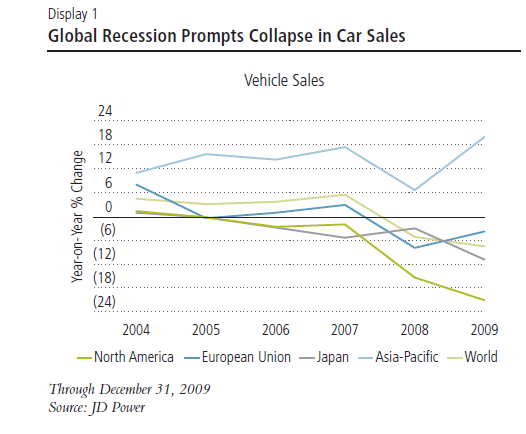

1. In developed markets car sales is declining. How many cars people buy have a direct impact on the earnings and stock prices of auto makers. When auto sales volume declines investors have to dig deeper in order to understand the timing and scope of recovery for this sector.

Click to enlarge

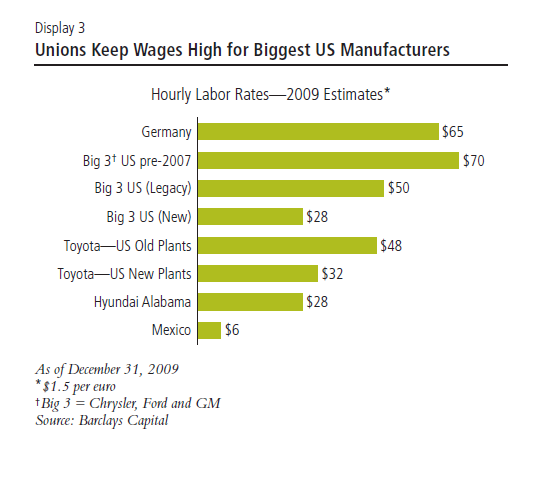

2. Labor unions in developed markets are powerful and demand lavish benefits and wages. Especially in the U.S., unions keep wages high for workers making American automakers uncompetitive in the global marketplace.

In spite of the recent bankruptcy and subsequent revival of GM(GM), wages and legacy benefits are a major cost for American automakers.

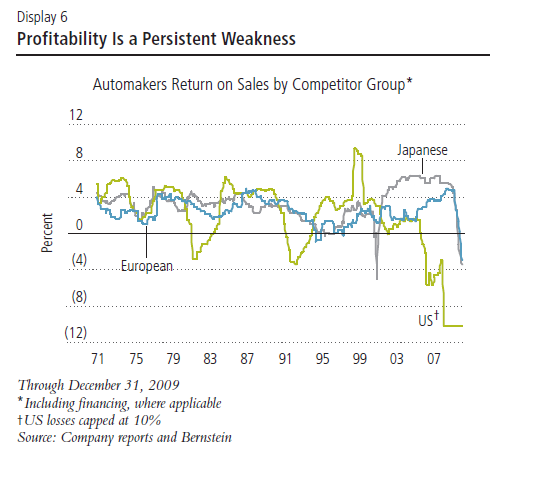

3. From an investment standpoint, the auto industry is one of the least profitable due to intense competition, large fixed-capital costs, cyclical swings hurt profitability, etc. As a result, the return on sales is just 2% on average across the industry.

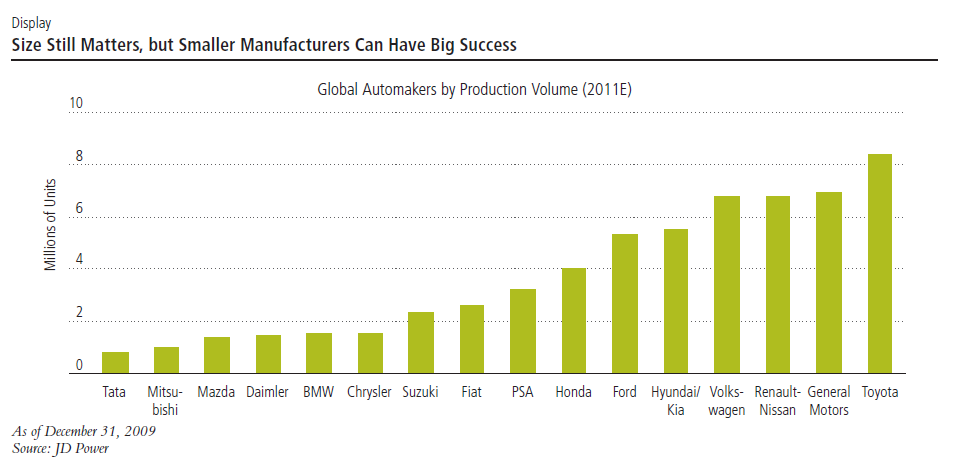

4. Size still matters in the auto industry. The largest automakers make and sell millions of units annually. However size alone does not guarantee success. For example, GM failed in 2009 and Toyota’s reputation was tarnished with recalls in early 2010. R&D is probably the biggest driver of scale in today’s auto industry.

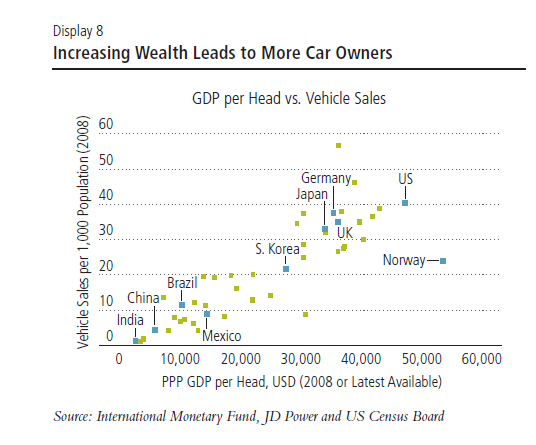

5. There is a direct correlation between wealth and auto consumption. Car sales in an economy usually take off once a GDP per capita of about $5,000 is reached. Hence emerging markets such as Brazil, China, India, etc. are experiencing exponential growth in auto sales as their GDP capita is increasing.

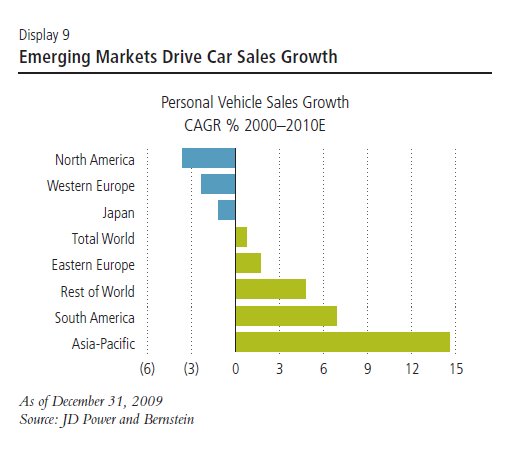

6. In the past 10 years, growth in the emerging markets has accounted for most of the increase in global vehicle sales. Sales in the developed markets of US, Europe and Japan declined as shown in the chart below. However this does not mean emerging market sales will drive automakers’ earnings higher in the coming years. Countries such as China give preferential treatment to domestic auto companies thus adversely affecting western automakers trying to take advantage of the booming auto market there. In India, domestic automaker Tata makes the $2,000 Nano beating the competition on price. Ford (F) lags behind other foreign car companies in capturing a larger share of the Indian market.

Source: Wheels of Fortune?, A Guide to the Global Auto Industry for Equity Investors, AllianceBernstein

Based on some of the points discussed above we can be conclude that investment in auto stocks is complex and that selecting winning companies require a deep fundamental analysis of the industry, individual companies, the direction of the economy and other factors. Some of the foreign auto companies that trade as ADRs in the U.S. market are Volvo (VOLVY), Toyota (TM), Tata Motors (TTM), Honda Morots (HMC), Daimler (DDAIY), Fiat (FIATY), Nissan Motor (NSANY), Peugeot Citreon (PEUGY) and Volkswagen (VLKAY). Due to rising gas prices and environmental awareness, consumers worldwide are increasingly attracted to smaller and fuel-efficient vehicles. Hence auto-makers that focus and excel in this space stand to perform well. Japanese automaker Nissan, French automaker Peugoet Citreon and Fiat, the Italian automaker are well positioned to benefit from the demand for small and fuel-efficient cars.

Disclosure: No positions