According to a research note by Goldman Sachs, the S&P 500 gained 255% in price appreciation in the last 20 years. When dividend reinvestment is considered, the S&P 500’s total return jumps to 439.3%. That amounts to a difference of an astonishing 184.3% in returns.

Goldman noted:

“Amid the slowing economic environment and historically high cash balances in corporate America … we believe that investors should continue to invest in companies whose dividend payouts will drive shareholder returns.â€

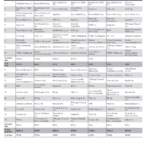

Hence Goldman Sachs searched for companies matching the following conditions:

- “Dividend yield (based on current stock price and projected 2011 dividend) must be greater than 10-year Treasury yield of 2.77 per cent;

- Company must not have cut its dividend in 2010;

- Goldman analysts must expect company to increase dividend in 2011;

- Because strong cash flow is necessary to sustain and increase dividends, free cash flow yield must be greater than 5 per cent;

- Net debt-to-equity ratio must be less than 1;

- Goldman must have a “buy†rating on the stock.”

The search returned the stocks noted below:

[TABLE=555]

Note: FCF = Free Cash Flow

Source: The Globe and Mail

In addition to the above nine equities, medical equipment maker Baxter International (BAX) also made it to the list. But the dividend data is not included in the list.Analog Devices(ADI), KLA-Tencor(KLAC) and Linear Technology (LLTC) are semiconductor firms that used to be hi-fliers during the dot com mania.