After defaulting on its debt in 2001, Argentina was shunned by international investors. Last year, Argentina was booted from the MSCI Emerging Markets Index. However the economy of Argentina may be ready for a rebound and catch up with the growing Latin American economies of Brazil and Colombia. In2001, Colombia was considered a failed state but since then the stock market has shot up fifteen times. Similarly Brazil could not service its debt in 1999 but now is the region’s and also one of the world’s red-hot emerging markets.

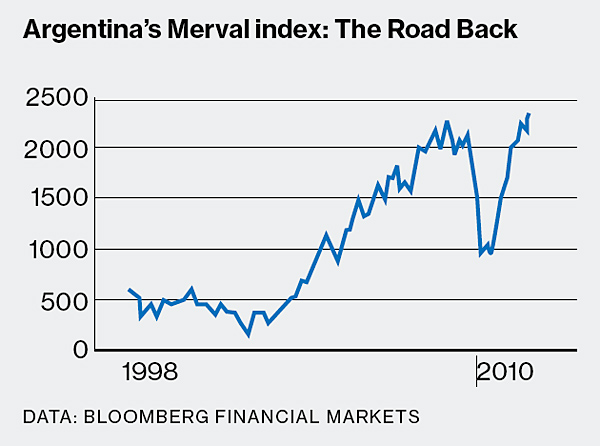

According to a recent article in Bloomberg Businessweek some investors are betting on a strong recovery in Argentina. The Merval stock index is up 163% since the credit crisis lows in November 2008.

Some of the reasons for the optimism mentioned in the article include:

- The Argentine government is trying to raise cash and build good relations with global creditors ahead of the presidential elections in 2011. After the rescue of Greece with an estimated $1 Trillion package, the outlook for Argentine debt swap deal is positive.

- The outlook for the export of agricultural products to other emerging markets is high

- Due to the availability of plenty of fertile lands, 54%Â of Argentina’s export is agricultural

- Publicly-traded banks are attractive compared to peers in the region

In terms of investment opportunities, there are a few ADRs that investors can consider. BBVA Banco Frances (BFR) has a market capitalization of $1.1B.The current yield on its ADR is 0.98% and the beta is 1.5. Banco Macro(BMA) pays a dividend of 2.38%. Oil and natural gas company YPF SA (YPF) is down about 18% YTD. The current yield is 7.94%. Telecom services provider Telecom Argentina(TEO) has a 11.04% dividend yield. Some of the other Argentina ADRs to review include oil and gas producer Petrobras Energia SA (PZE), food producer Credud (CRESY)and electric utility Edenor(EDN).

Be careful ! Argentina is being ruled by the most crooked government in the history. They are faking the National Index Institute (INDEC) and say there has been little or no inflation in the last few years. Any Argentinian citizen knows we have had a 300% inflation in the last 5 years or so. Salaries have been trippled within the same period, Consumer products may be more than that. However, these people who have been lucky enough to base their growth in agricultural products, still have enough export dollars to pay for this party. This 300% inflation is said by the government to have been only probably 40% of the real value to say the most. In the meantime, they have been lucky enough to export and keep the Argentine Peso only a 30% higher than 6 years ago. This, after ripping off the Social Security Private Managing firms just like Castro or Chavez would do and leave the retiring funds empty. They ripped off the Central Bank against the National Constitution. Now they are paying the party with National Reserves. This, not to mention they tried to take over the Farmer’s profits in exports on 35% export tax (on top of regular taxes). So the Phrase “Look for trouble if you want bigger Returns” , is very well applied. Keep in mind. next year there are elections. They are trying to perpetuate in office through paying off low social class voter’s. Any investment should be clear that next year is a very dangerous area to catch you long in Argentinian assets

Alex

Thanks for your comments.I appreciate it.