The Top 10 banks in Greece based on assets held is listed below. The $141 billion bailout package put together by European Union and the International Monetary Fund should help Greece from bankruptcy. Germany is expected to contribute $28b to this bailout fund and the plan has been approved the German parliament.

One of the main areas that will get the attention of Greek regulators and politicians is the country’s banking system since a sound banking system is the backbone of any economy. Hence investors are currently interested in evaluating the Greek bank stocks as they may rebound sharply from current levels.

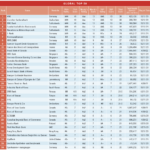

The Top 10 Greek Banks by Assets Held:

[TABLE=494]

Source: Highlights of the Greek banking sector 2008-2009, Deloitte

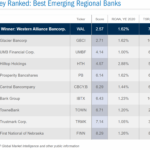

National Bank of Greece (NBG) closed at $2.67 on Friday. The 52-week high is $8.37.On April 30th, S&P maintained its”Sell” recommendation of NBG. Alpha Bank (OTC: ALBKY) ended at $1.80. However this year Greek banks are projected to have improved deposit margins. Other banks that trade as Unsponsored ADRs include Agricultural Bank of Greece S.A. (OTC: ABGEY), EFG Eurobank Ergasias S.A. (OTC: EGFEY), Marfin Popular Bank Public Co. Ltd. (OTC: MYPSY) and TT Hellenic Postbank (OTC: TTHPY).