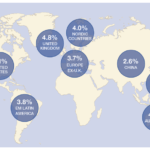

Investing in foreign stocks is an integral part of a well-diversified portfolio. There are many reasons for this strategy. Some of them are noted below:

- The total market capitalization of all stocks listed in the New York Stock Exchange is about $11.8 Trillion as of Dec 31,2009. Over 400 foreign stocks account for a significant portion of this total market capitalization

- Last year in US dollar terms the market capitalization of Shanghai, Bombay, Bovepsa exchanges grew by 89%, 101% and 125% respectively while the market cap of NYSE grew by only 28%

- More capital for IPOs and secondary market issues is raised in foreign markets than in the US exchanges

(Source: World Federation of Exchanges)

Many foreign stocks have traditionally paid higher dividends than US stocks. Investors can profit handsomely picking up some of these dividend payers. For example, I started a small position in a foreign bank back in 2006. So far I have received 29% of my original investment in just dividends and my current yield is over 10%. With dividend reinvestment and rise in share price, the total return is much higher. It must be noted however investing abroad comes with additional issues such as exchange rate risk, political risk, taxation, volatility, etc.

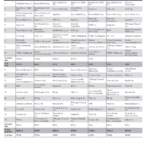

To identify some of the high yielding large cap foreign stocks, I ran the screener with the following criteria:

1. Stocks must trade on the NYSE

2. Market cap must >= $5B

3. Dividend yield must be at least 3%

Large NYSE-listed foreign companies with dividend yields of 3% or more:

[TABLE=476]

Note: Canadian stocks are excluded in this list

Key Takeaways:

1. Just 6 of the stocks in the list are in the financial sector

2. Some of the global oil companies such as Royal Dutch Shell (RDS.A), TOTAL (TOT), have excellent dividend yields

3. Of the telecom-sector stocks, Telefonica of Spain(TEF), France Telecom (FTE) and Deutsche Telecom (DT) pay over 6% dividends