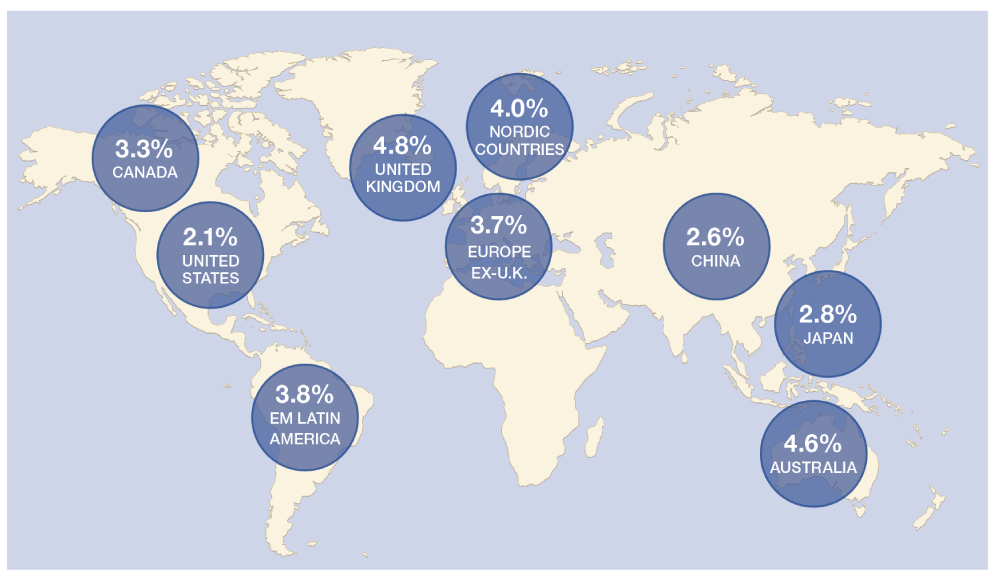

When picking dividend stocks, in addition to an attractive dividend yield it is important to select stocks that have high annual dividend growth rate.These two factors will give a better picture about the stocks than going with just the yield alone.

The following foreign stocks satisfy the two conditions:

Dividend Yield = > 2%

Average Annual Dividend Growth Rate in the past 5 years = > 10%

1.Endesa-Empresa Nacional de Electricidad (EOC)

Chile

Current dividend yield: 2.23%

Average Annual Dividend Growth Rate: 36%

2.Enersis (ENI)

Chile

Current dividend yield: 2.24%

Average Annual Dividend Growth Rate: 14%

3.National Grid (NGG)

UK

Current dividend yield: 4.56%

Average Annual Dividend Growth Rate: 13%

4.Veolia Environnement (VE)

France

Current dividend yield: 5.15%

Average Annual Dividend Growth Rate: 17%

5.Bancolombia (CIB)

Colombia

Current dividend yield: 2.76%

Average Annual Dividend Growth Rate: 34%

6.Corpbanca (BCA)

Chile

Current dividend yield: 4.84%

Average Annual Dividend Growth Rate: 26%

7.Bank of Novo Scotia (BNS)

Canada

Current dividend yield: 4.16%

Average Annual Dividend Growth Rate: 12%

8.Bank of Montreal (BMO)

Canada

Current dividend yield: 5.13%

Average Annual Dividend Growth Rate: 12%

9.Royal Bank of Canada (RY)

Canada

Current dividend yield: 5.33%

Average Annual Dividend Growth Rate: 15%

10.City Telecom (CTEL)

Hong Kong

Current dividend yield: 7.56%

Average Annual Dividend Growth Rate: 16.12%

11.Portugal Telecom (PT)

Portugal

Current dividend yield: 7.34%

Average Annual Dividend Growth Rate: 27.60%

Note: Data noted above is believed to be accurate. Please do your own research before making any investment decisions.