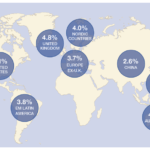

Investors looking for consistent dividend-paying foreign stocks are attracted to Canadian equities. There are many Canada-based companies that pay decent dividends and have excellent dividend growth rates too.

In order to identify some of the high dividend growth Canadian stocks we shall use the Canadian High Yield Dividend Growth 30 Portfolio Index created by Mergent, the creator of the Dividend Achievers family of indices.

Description of the Index:

“The Canadian High Yield Dividend Growth 30 Portfolio is comprised of Canadian companies that trade on a major Canadian exchange and have five or more years of equal or increasing regular annual dividend payments. Companies must have a minimum average daily cash volume of US $3,000,000 and a current dividend yield of 1% prior to each Annual Reconstitution Date.”

The National Bank of Canada and all Canadian companies that are income trusts or REITs are excluded in this index.

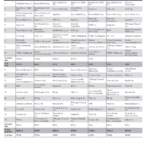

The Top 10 Holdings in the Canadian High Yield Dividend Growth 30 Portfolio are:

[TABLE=231]

Note: Current dividend yield is noted if the stock trades on the US exchanges

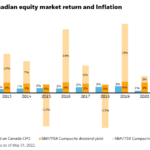

The average return of equity for the index constituents is 11.65% and the dividend yield is 3.91%. As of September30, 2009 the total return for the index is about 47%. The average 5-year dividend growth rate is 7.43%.

Note: All index calculations are in Canadian dollars

Growth of C$10,000 from 1999 thru the end of 2008:

To download the full listing of the Canadian High Yield Dividend Growth 30 Portfolio, click here.

To download the latest factsheet, click here.