Recently the highly influential AméricaEconomÃa magazine published a list of The Best 25 Banks in Latin America for 2009. This list differs from the earlier list that I posted back in June where I listed the top banks by country in Latin America.

The Top 25 Banks in Latin America

Click to Expand

Source: AméricaEconomÃa

Note: Cl = Chile, BR = Brazil, EC= Ecuador, MX = Mexico, CO= Colombia, PE = Peru

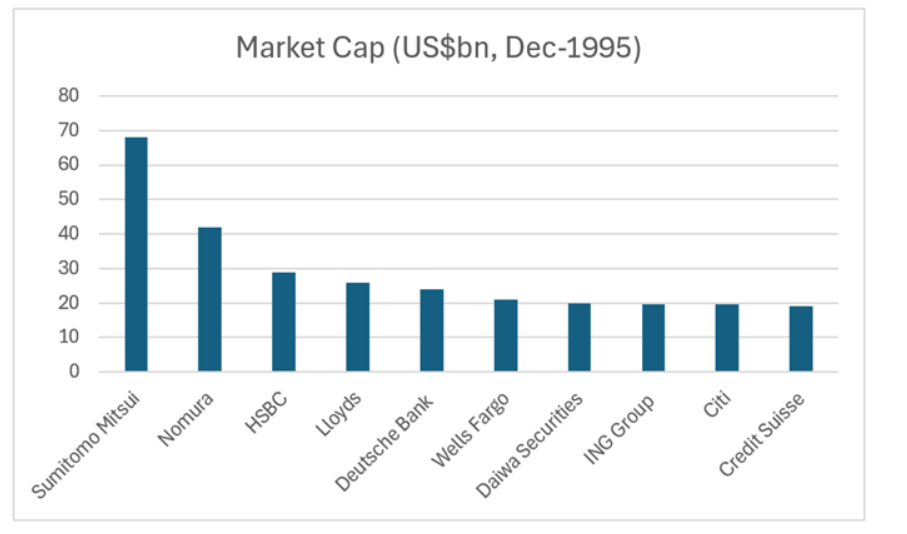

During the credit crunch and the following recession many US banks have filed and the banking sector is still suffering from losses with no end in sight.Yesterday marked the 99th bank in the US. However banks in Latin America have prospered during the same period. For example, in September this year the market capitalization of banks in Peru rose by over 50% compared to a fall of 2.3% for US banks. For Brazil banks, the increase was about 24%. The average profitability of Latin American banks was 15.6% while most US banks are still in the red.

Basel Index:

This index measures the capital to risk-weighted assets of a bank. This index for Latin American banks is about 15% compared to 12% for banks in the US, Germany and the UK.

After acquiring Unibanco, Itau Unibanco (ITUB) Bank of Brazil jumped two positions from last year easily beating state-run Banco do Brasil and Bradesco(BBD). Itau has also become a strong global player in the banking industry. The Mexican and Brazilian banks were vulnerable during the worldwide economic crisis last year. However they came out of the crisis strong without having any liquidity or solvency problems. Banks in Peru, Colombia entered the crisis with a strong position and have since emerged even stronger due to prudent risk control measures and regulations.

Other banks that are included in the above include subsidiaries of Spanish banks Santander (STD) and BBVA (BBV) and Canadian bank Bank of Novo Scotia (BNS). Chilean Bank Banco Santander (SAN), BancColombia(CIB) of Colombia also made it to the list.