The main stock market index the Bombay Sensex is up 79.6% year-to-date. Is this astonishing rise justified by fundamentals in the economy or is the Indian stock market forming another big bubble?. In this post let me present some points to indicate that the stock market in India is in fact forming a bubble that is not sustainable.

One of the main reasons the US economy collapsed recently is the long-term explosive growth of the financial sector. In the past few decade the US economy was mainly driven by the financial sector. The FIRE economy was comprised of Financial, Insurance and Real Estate sectors. Historically the financial industries that included banking, investment banking performed the simple function of lending and deposit-taking and channeling capital from investors to companies that needed them. They acted as a middle man offering a valuable service and earned a percentage of the transactions involved. Similarly the real estate industry was a boring industry that comprised of mainly building and selling homes to people that could afford them. The insurance industry also concentrated on offering auto, home and other insurance services to customers. However all the traditional roles were abandoned in the past few decades as companies evolved into high profit making machines in a short time with strategies involving high-octane risk taking. As the financial industry became the main driver of the US economy, other sectors that constituted the real economy such as manufacturing lost their significance.

The dramatic rise of the importance of the financial industry can be seen in the following chart:

Click to Expand

Source: TheAtlantic.com

Writing in The Atlantic in an article titled The Quiet Coup Simon Johnson noted:

“From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent, higher than it had ever been in the postwar period. This decade, it reached 41 percent. Pay rose just as dramatically. From 1948 to 1982, average compensation in the financial sector ranged between 99 percent and 108 percent of the average for all domestic private industries. From 1983, it shot upward, reaching 181 percent in 2007.”

Thus the financial sector’s profit alone were an incredible 41% of total domestic corporate profits in the past decade. As a result of this growth, compensation levels in the industry sky-rocketed to astronomical levels. During this bubble period, MBAs were minted by the thousands and any college graduate wanted to work in Wall Street or the banking industry and make millions.

The financial sector’s GDP share also increase significantly in the period from 1990 to 2006. In the US, it increased from 23% to 31%, a full 8 percentage points. In the UK, it was more than 10% but in France and Germany it was only in the 6% range. The chart below shows the growth of the share of the financial sector in GDP for select advanced economies since the mid 80s.

Click to Expand

Source: How might the current financial crisis shape financial sector regulation and structure?, Bank for International Settlements (BIS)

Alan Greenspan’s cheap money provided fuel to the fire culminating in the formation of the credit bubble. Once the bubble was popped in late 2007, the US economy and indeed the global economy went into a tailspin.The financial sector saw the collapse of many formerly solid and reputed firms like Lehman Brothers, Bear Stearns, Washington Mutual, IndyMac Bank and many others. The wrongfully named real estate proved to be a fake sector ending in the foreclosures of millions of homes and thousands of empty shopping malls and office buildings in the commercial space. In the insurance industry other than AIG no major failures happened since insurance is one industry that is highly regulated and is controlled by the individual states. AIG’s collapse was caused not by its insurance arm, but by its tiny financial division which played big in the derivatives market. The financial and real sector that triggered the global economic crisis was responsible for the millions of jobs that vanished overnight worldwide and trillions of dollars in wealth that were wiped out. In a nutshell, the so-called FIRE economy burned the US economy very badly.

So by now you are wondering what does the above have anything to do with the Indian economy. Well there is a lot in fact when we compare the US and India. Similar to the US, where the financial sector became a major part of the economy, the banking sector and insurance sector is growing to be a big part of the Indian economy.

The banking and insurance sector contributed less than 11% in 1990. In 2007 it amounted to about 15%. While it is still less than the growth of the financial sector in the US, it is still a cause for concern. The financial sector is growing rapidly in India and is fueling various speculative bubbles including the real estate bubble.

A few of the other factors that is inflating the bubble in India include:

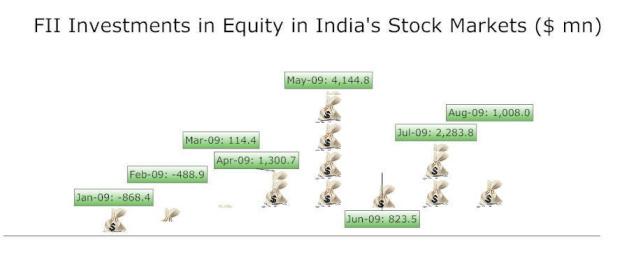

1. From its March low of 8,160 the Sensex closed at 17,326 on Friday for a gain of over 100%. In the past few months Foreign Institutional Investors (FIIs) have poured at least $1B monthly in the Indian market pulling it all the way to 17K+ levels in just 6 months. While a billion $ is not much in a developed market like the US or in Europe, it has a lot of weight in emerging markets like India where most stocks do not have high trading volumes. Hence it is easy to move the market one way or the other with large bets.

Source: Frontline

The current P/E of the market is over 21.The fundamentals of the economy does not support this growth in the market. When foreign investors pulled out nearly $12B from the market the bottom fell out. Now they have poured in around $9B till September this year.

2. Due to political interference India does not have the capacity to absorb all the foreign capital flowing into the country. This is especially true with Foreign Direct Investment (FDI) where land acquistion for factories is a huge problem. According to a BusinesWeek article “What’s Holding India Back” some $98 billion in investments by business is on hold due to farmers unwilling to sell land for industrial purposes.

3. Corruption at all levels is another drag on the economy. From petty government office clerks to high level multi billion dollar military deals, corruption is common.Transparency International ranks India number 85 in its annual corruption perceptions index.

4. The Real Estate sector is the largest bubble India has ever seen. Prices of ordinary house, apartments and even land have skyrocketed in the past few years. Speculators play the real estate market like Americans did up until 2007.

5. The IT sector is given too much importance when in fact it employs a tiny percentage of the working population. Despite the foreign exchange the IT industry brings into the country, the IT industry is just considered as a cheap labor source for foreign companies looking to save money. Many domestic Indians do not trust in the IT sector helping in the development of India.

6. Exports are down at the annual rate of 20% thru September this year. Domestic consumption cannot replace the fall in exports to overseas markets.

7. In addition to the foreign capital, the majority of the current growth is coming from government spending thru stimulus plans. The government borrows heavily to fund the expensive stimulus plans. Once the spending is over growth will slow down to a trickle.

8. Stocks are rising to sky high levels without strong fundamentals. Many stocks jump double digit percentages in a week like during the dot-com bubble era in the US. Speculation is rampant with many investors trying to make a quick buck as the market keeps going up. After last years dramatic fall, irrational exuberance has returned to the Indian markets.

9. The lack of a vast bond market, forces many investors to invest in the equity market which pushes prices to abnormal levels.

Some of the Indian ADRs that trade in the US markets include HDFC Bank (HDB), ICICI Bank (IBN), Tata Motors (TTM) and Infosys Technologies (INFY) .