HSBC Holdings Plc (HBC) of U.K. was awarded the title of “Best Global Bank” by the highly respected Euromoney magazine in London on July 8th.

Congratulating the bank Euromoney said:

“After a period in which banks suffered for putting too many eggs into too few baskets, one of the things that stands out at HSBC is the diversity of its business. It is a truly global bank.HSBC has adopted a clear policy of focusing expansion on emerging markets, and to place the bank in a position to focus on the international connectivity of those markets with the developed world. It is scoring a number of successes. The bank achieved almost full subscription to the rights issue. No other bank could have raised so much money in this way at that time. The market had made a judgment on HSBC.”

The CEO of HSBC, Michael Geoghegan commented “Conservativism, strong capital management and responsible practice have certainly been the core of HSBC since we were founded in 1865. In practice, this character is personified every day by our 300,000 plus staff around the world and it’s on their behalf that I am delighted to accept the global bank of the year award for HSBC.”

The CEO of HSBC, Michael Geoghegan commented “Conservativism, strong capital management and responsible practice have certainly been the core of HSBC since we were founded in 1865. In practice, this character is personified every day by our 300,000 plus staff around the world and it’s on their behalf that I am delighted to accept the global bank of the year award for HSBC.”

Currently HBC has a 3.95% dividend yield and a market cap of $98.4B. The stock has nearly doubled from its March lows of nearly $23. HSBC made a disastrous deal back in 2002 when it acquired consumer finance company Household International. As a result of losses with the purchase, HSBC had to take a $10.6 billion goodwill impairment charge. After that deal, the bank made many strategic changes and positioned itself to be a strong survivor once the credit crisis hit the markets worldwide. HSBC never took British government bailout funds and successfully raised money with a rights issue. The bank that calls itself “The World’s Local Bank” has a strong presence in many countries especially in Asia since it was originally founded in Hong Kong.

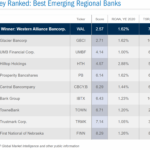

Euronomey named Standard Chartered of the U.K. as the best emerging market bank. Called simply as Stanchart, it does trade in the U.S. markets.

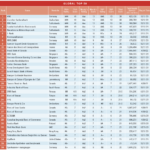

The list of other global award winners for “Awards for excellence 2009″Â are:

Best commodities house    – Morgan Stanley (MS)

Best corporate restructuring house    – Lazard

Best DCM house –   HSBC (HBC)

Best ECM house   - Goldman Sachs(GS)

Best emerging market debt house    – Citi (C)

Best emerging market equity house –  J.P.Morgan (JPM)

Best emerging market investment bank -Â J.P.Morgan (JPM)

Best emerging market M&A house   – Credit Suisse(CS)

Best equity derivatives house –  Societe Generale Corporate & Investment Banking (SCGLY)

Best foreign exchange house    – Barclays Capital (BCS)

Best hedge fund   - Paulson & Co

Best infrastructure and project finance house – Â Â BNP Paribas (BNPQY)

Best investment bank    – Credit Suisse (CS)

Best investor services house   - Bank of New York Mellon (BNY)

Best M&A house –  J.P.Morgan (JPM)

Best private equity firm   - Blackstone

Best risk management house- Â Â Â Deutsche Bank (DB)

Best securities restructuring house   - Goldman Sachs (GS)

Best short-term debt house  - Goldman Sachs (GS)

Best sovereign advisory   - Rothschild

Best structured products house – Â Â RBS (RBS)

Best transaction banking house –  HSBC (HBC)

Best wealth management house   – Credit Suisse (CS)

Source: Euromoney