For the long-term investor looking for dividend stocks in this market there are plenty of opportunities at attractive prices. Financials is one of the worst affected sectors due to the sub-prime crisis. Some of these financial stocks have fallen over 50% since past October. However in my opinion some of the European banks have become cheap and are decent picks at the current levels.

Traditionally European banks have paid higher dividends. While higher yield is good, it is also important to review the payout ratio and the annual dividend growth rate. These two factors give a better picture about a particular dividend stock than just the yield alone. So I have compiled the following list of European bank stocks (ADRs) with the dividend yield, dividend growth rate and the payout ratio listed for each stock.

Some of the reasons why European banks are better than US banks are:

1. Except UK and to some extent Spain, the housing market has not crashed in other countries. In countries like Germany it is not easy to get a residential mortgage since most banks follow traditional banking practices.

2.UK seems to be an exception in that it loosened some of the lending laws for mortgage loans similar to US. Besides property prices in UK have risen for many years since there is belief that being an island, land is limited and demand is always high.

3. Many banks in Europe actually own the loans they originate and do not get involved heavily in derivative instruments.

4. Some of the banks that have had losses have shored up their capital base to weather the current credit crisis.

5.Banks from the former superpowers tend to have long established ties and strong presence in the colonial countries. For eg. – British bank Barclays operates in many Caribbean countries and India, the jewel in the crown during the empire days.

6.In this years ranking of “The Top 50 Banks in the World” in terms of assets held

European banks dominate the top 9 positions. (Source: www.BankersAlmanac.com)

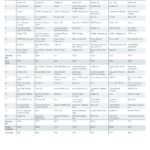

A) European Banks – Dividend Yield, Dividend Growth Rate and Payout Ratios

[TABLE=88]

Corrections- Please note the following updates that will be made tomorrow for the above table:

1.Bank of Ireland’s ticker is IRE not IREC.

2. LYG has yield of bout 13%.

3.The yield for RBS is not 22.39% as the above table says. This is an error and will be fixed tomorrow. Thanks for your understanding.

B) Chart

Click on the chart to enlarge.

C) Payout Ratios Chart

Analysis:

1. Deutsche Bank annual payout ratio is just 30% and the yield is 7.42%. With Germany having the largest economy in Europe and the possibility that dividends can be raised in the future it may be a better bet. The recent takeover of Dresdner Bank by Commerzbank (OTC: CRZBY) will have an impact on the German banking industry.

2.Llyods tops this list with a high yield and a great payout ratio. However the dividend growth rate has been stagnant in the past 5 years. Note: The Dividend yields for British bank ADRs like Llyods are actually higher than the rates mentioned in the table above since they are computer generated and British banks pay a variable dividend each year. Thanks to a reader who pointed out this to me in an earlier article.

3. ING is growing in many emerging market countries and has a stable, high dividend yield. Other than banking ING operates in the insurance and asset management businesses as well.

4. Spanish banks like BBV and STD offer exposure to the fast growing Latin American emerging markets. Last year BBV purchased Compass Bancshares in the US for $9.6B. Some believe that it was not a wise move for BBV at that time and as we know now the timing was wrong as well.

5. Due to the downturn in Irish economy the Irish banks IRE and AIB have very high dividend yields. As the economy improves they should do well.

6. HSBC Bank has a nice yield and a good payout ratio of 52%. Though HBC has high US exposure compared to other British banks it has held up well in this market. This is due to many efficient and forward-thinking initiatives implemented by the bank.

Disclosure: Long BBV,LYG, ING, RBS, STD

Note: All data is thought to be accurate at the time this article was written.Please do your own research before making nay investment decisions.

In the above dividend analysis, I have not addressed the tax implications for US investors and the points presented are based on my opinions. Readers feel free to add your comments and suggestions.

Once again, an analysis of foreign stocks gets the dividend yield wrong. You’ve either taken it from Yahoo or Google, but the figures are wrong. British banks pay dividends twice annually at different rates, called an interim and a final dividend. Many sites merely take the interim dividend and double it; hence the mistaken yield. LYG is actually yielding about 13% presently, for instance. Consult S&P reports for the correct figures. RBS, by the way, is not paying a final dividend in cash, but in shares. This is, in effect, a dividend cut, and will be dilutive going forward, so the 22% figure is way off.

Hi

Sorry for the delayed reply.I got the dividend info. from my broker’s stock screening software.I will check with them to see how accurate it is.Yes I know that UK banks and many companies there pay interim and final dividends. You are correct about the dividend for LYG.I just checked.My broker’s data is wrong. Reuters site has it as 14.87% which is above than 13% on the day posted this comment.As you know all stocks fell heavily today and hence the boost in yield.

When I ran the numbers I thought that 22% was weird.I was gonna make a * on that value and put a footnote to advise readers that I was gonna check or they check this RBS data.Then I forgot to do that.I will make the two corrections you have pointed out tomorrow.

Thanks for your comment and catching the errors.:)

-David