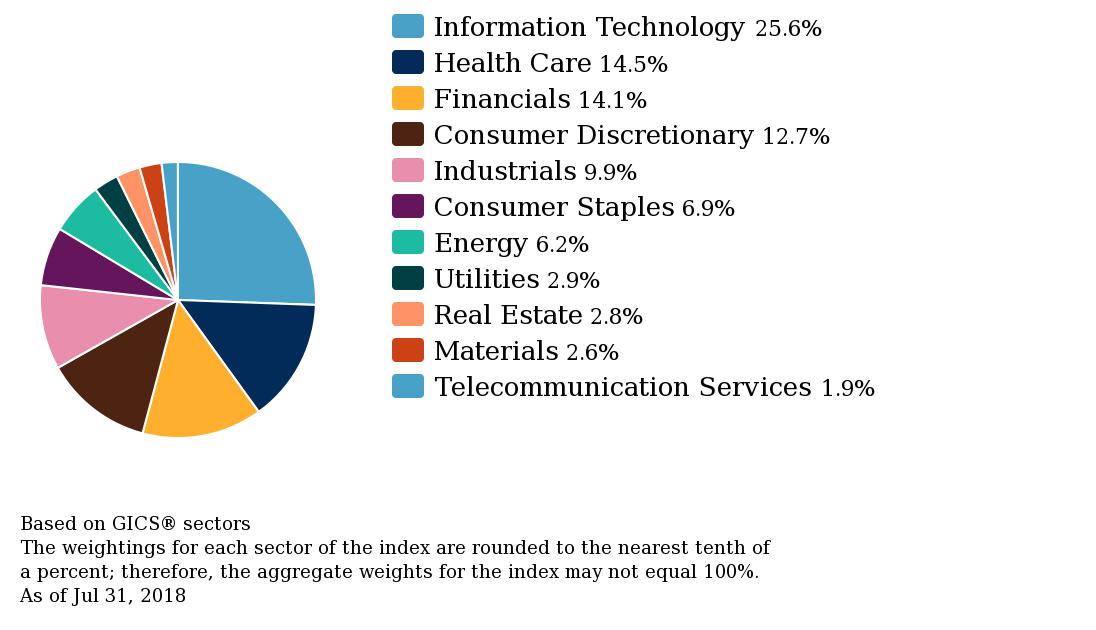

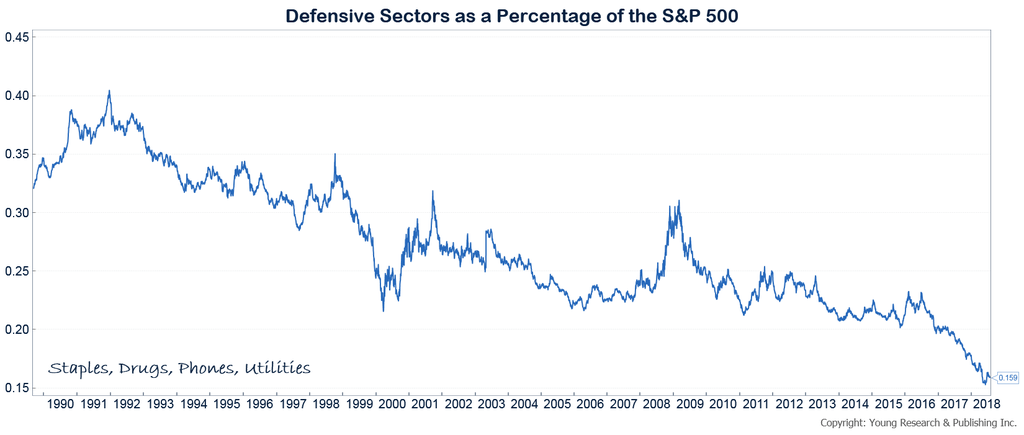

The S&P 500 Index is not as diversified as many investors think. In fact, the IT sector alone accounts for just over 25% of the index and the weightage of the defensive sector has fallen continuously since the 1990s.

S&P 500 sector breakdown:

Click to enlarge

Source: S&P

The defensive sector used to account for 35% to 40% in the early 1990s. Since then it has declined to reach 16% now. In the past two the decline in weightage has accelerated sharply according to Matthew A. Young of Young Investments.

Click to enlarge

Source: July 2018 Client Letter: Are you Prepared for the Next Stock Market Downturn?, Young Investments

The high allocation to the tech sector is big risk for investors especially during market corrections or a bear market. From the above article:

If the S&P 500 was able to fall more than 50% during the last two big bear markets when defensive stocks were a greater share of the index, what happens during the next big bear market?

The biggest sector in the S&P 500 today is technology. During the dotcom bust, the S&P 500 technology index plunged 83%, eviscerating the savings of millions of investors loaded to the gills with technology shares.

According to the most recent Bank of America Merrill Lynch Fund Managers Survey, the most crowded trade on Wall Street today is big technology stocks.

Unsuspecting index-based ETF investors may have an unpleasant surprise in store during the next market downturn. That seems to be the opinion of Jim Rogers. Rogers was the co-founder of the Quantum Fund, one of the most profitable hedge funds on record. Rogers expects the next bear market to be “horrendous”—maybe even the “worst”—and he thinks ETFs could collapse more than anything else because that’s what everybody owns. ETFs are of course supposed to trade near the underlying value of their assets, but during sharp market moves we have seen prices diverge widely from the underlying value of those assets.

The key takeaway for investors is that the S&P 500 should not be considered as well diversified. Hence products derived off of the index such as ETFs or mutual funds will perform poorly in adverse market conditions.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions