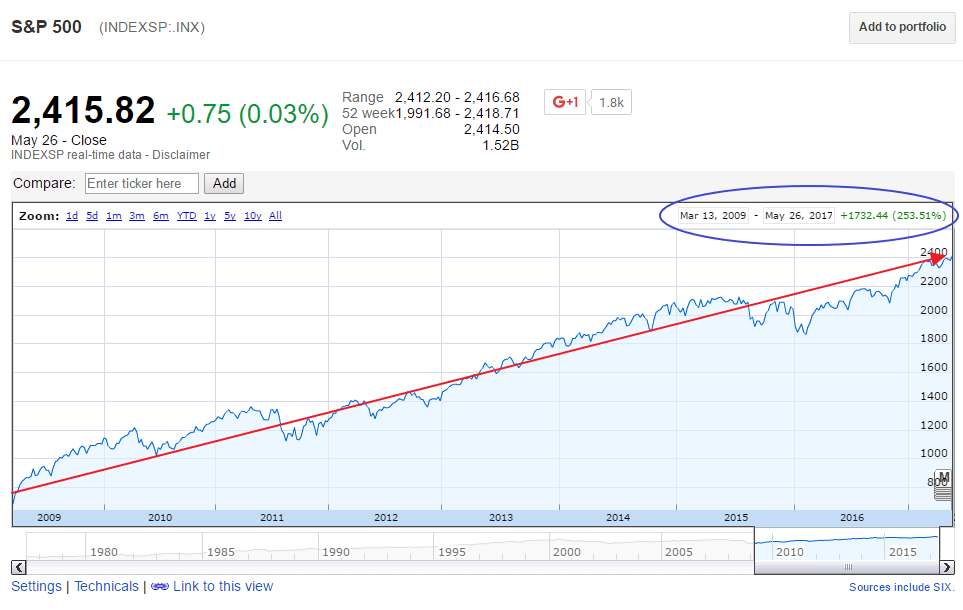

One of the important traits that successful investors have is emotional control. While it is easier to watch a portfolio grow during bull markets the same cannot be said during bear markets when stocks can go down 50% or more or even to near zero. In such scenarios, the key is to keep calm and focus on the long-term goal and not panic. Simply selling out everything at the peak of a brutal market correction is not a wise strategy. For example, during the market correction during 2008-09, some investors panicked and sold their stocks at the worst time around early 2009. Since the lows of early 2009, the S&P 500 has more soared by more than 250% based on price only. So investors that had the misfortune of liquidating their holdings back then lost out this astounding return when US stocks rebounded with a vengeance.

Click to enlarge

Note: Chart shows data till May 26, 2017

Source: Google Finance

According to an article by Dianne Lob, Scott Krauthamer at Alliance Bernstein, stocks have usually rebounded sharply after large intra-year declines. The S&P 500 has exhibited this phenomenon in the past 20 years. From the article:

Market trends also require context. At some point during 20 of the last 37 years, US equities have been hit by a peak-to-trough decline of at least 10% (Display). These episodes always trigger anxiety and make investors search for the exits. Yet, the bounceback is often very quick. Stocks have posted full-year declines in just six of those 20 years.

Dumping stocks during a decline is usually a mistake. Since stocks have delivered positive annual returns in most years, getting out of the market during a sharp correction often means locking in losses and forfeiting returns in a rebound. And it’s almost impossible to time market inflection points.

Today’s extremely low volatility levels have reinforced investors’ complacency. It’s easy to forget how often equity corrections happen—and how quickly the market tends to rebound. That’s why it’s so important to keep the historical context in mind before the market takes a hit.

Source: US Equity Correction? Prepare, Don’t Panic, Alliance Bernstein, May 25, 2017

Below are a few points to keep in mind when markets enter a correction phase:

- Keep calm and carry on as usual.

- Be patient when the media scares everyone and it seems like the world is coming to an end.

- Do not suspend dividend reinvestments unless there is a need for cash.

- If available, deploy cash to work by buying high-quality stocks cheap when they get dumped with other stocks.

- Perform tax-loss harvesting or Traditional IRA to Roth conversions if needed for tax purposes. These technics are applicable to US investors only.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions