Stocks usually tend to outperform cash and other asset types over the long-term measured in 5 years or more. The performance gap between stocks and cash over decades is even more wider due to the effect of compounding returns due to dividend reinvestment.

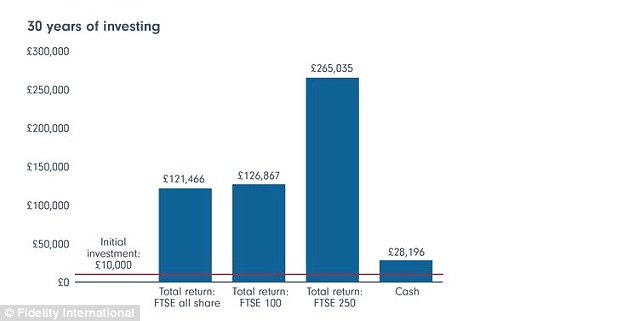

While holding cash in a savings account offers safety and peace of mind, cash is not the best vehicle to build wealth. The following chart from Fidelity UK shows the 30 year returns of stocks vs. cash:

Click to enlarge

Source: Why long-term investing works: How putting £10K into the stock market would have earned you £90K more than cash savings over three decades, This is Money

An initial investment of £10,000 in 1986 in the benchmark FTSE 100 would have grown to £126,867 based on total return which includes dividend reinvestment. The same amount in FTSE 100 would be worth £121,466. An investment of the same 10K in the FTSE 250 would have grown to £265,035 in the past 30 years.

Had an investor stashed the cash in a savings account, the investment would have grown to only £28,196.

Hence they key to success equity investing is to hold high-quality stocks for many years and do not panic and sell when markets turn volatile. Selling out during panics such as the recent Brexit drama is not a wise move.