*** UPDATE: For the latest Dividend Withholding Tax Rates click :

Dividend Withholding Tax Rates By Country 2022

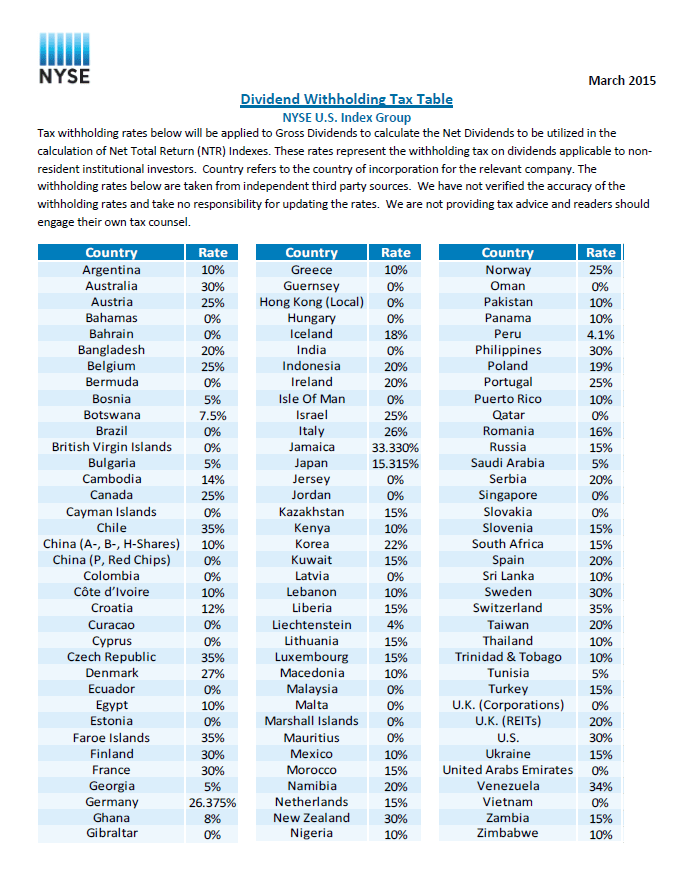

Dividend Withholding Tax Rates is an important to consider when investing in foreign stocks for US-based investors. These taxes vary by country and can be as high as 25% or more or as low as 0%.

The following table shows the dividend withholding tax rates for 2015:

Click to enlarge

Source: NYSE

Here are two points to consider:

- Though the rate for Canada is noted as 25% above, it is actually possible to get a reduced rate of 15% for taxable accounts by filling a form with the tax authority of Canada. Also Canada does NOT deduct withholding taxes from dividends of stocks held in retirement accounts such as IRAs, 401Ks, etc. Hence it is a smart move to hold Canadian dividends stocks in retirement accounts.

- A few countries such as UK, Malaysia, Singapore, India, etc. do NOT charge any dividend taxes for all types of accounts. Investors hunting for income stocks can focus on these countries although Indian stocks are not known for high dividends.

To save for future reference: Download the above table in a pdf document.

*** UPDATE: For the latest Dividend Withholding Tax Rates click :

Related:

- New Requirements for Canadian Tax Withholding for US Investors

- An Important Update On Canadian Reduced Tax Withholding Rate For US Investors

I am an individual who own stocks of corporation from many countries outside North America. My stockbroker is inapt when it comes to ensure the adequate foreign withholding tax on dividends is applied. The general problem is:

1-My stockbroker does not want to handle neither the Claim of Tax Treaty Benefits nor the Tax Refund Claim forms.

2-The country where the company is located keeps telling me to go to my broker as they are suppose to handle it.

3-My domestic country does not want to be involved and their tax agents have no clue.

This seems to be a problem many investors face. I do not want to get too much into the specifics of my case at this point since it could be easy to get lost into the details.

Questions 1- Is there a way for me to ensure I get the refund for the excessive foreign withholding tax, meaning above the tax treaty rate?

Questions 2-Is anyone aware of a global stockbroker which will handle the paperwork as in #1, as opposed to simply give their customers the brush off.

Regards,

Emmanuel

See my answers below:

Questions 1- Is there a way for me to ensure I get the refund for the excessive foreign withholding tax, meaning above the tax treaty rate?

Ans:

Yes.Only if your broker cooperates and you are able to file the needed paperwork.

Questions 2-Is anyone aware of a global stockbroker which will handle the paperwork as in #1, as opposed to simply give their customers the brush off.

Ans:

Without specific details it is not possible to answer this question. Reputed brokers in the US will help with your situation. If your broker is so bad, then maybe you can change the broker.

Thanks

-David