The Australian equity market provides one of the best opportunities for investors hunting for foreign dividend stocks. As a developed economy the country has positive factors that are common in other developed countries such as those in Europe, the US, etc. For example, political risk is practically zero. Though the Australian economy is a resource-based economy there are plenty of companies that operate in sectors outside of natural resources. These firms offer stable income with steady growth and are not highly impacted by the downturn in commodity markets.

Six reasons to consider Australian dividend stocks are listed below:

- Unlike firms in other developed markets, Australian companies pay out a high proportion of their earnings as dividends.The payout ratio for Australian companies stood at 75% as of August this year compared to just 31% in Japan, 49% in the UK and about 35% in the U.S.

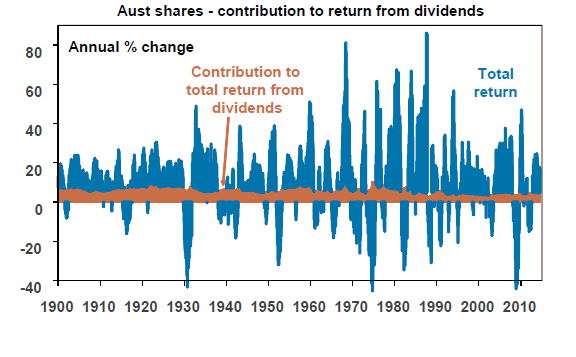

- Dividends paid out by Australian firms are stable compared to their earnings.Hence sustainability of dividends is not an issue. Click to enlarge

- Of the 11.8% per year total return produced by Australian stocks since 1900, just over half have come from dividends.

- Australian dividends provide a positive contribution to the total return during uncertain market conditions. Click to enlarge

- While most countries tax earnings twice – once from companies and once from shareholders – dividends are not taxed twice in Australia due to a unique arrangement called “franking”. This structure encourages Australian firms to pay decent dividends as opposed to hoarding earnings. In the US, many companies irrationally hoard billions of dollars in shareholder wealth with the hope of reinvesting them in the business sometime in the future. Until that happens, investors are forced to settle with puny dividend yields.

- The dividend yield for Australia is 4.4% as of Dec 11 according to FT Market Data. This is more than double that of the US dividend yield at just 2.0%.

Source: Why I love dividends and you should too by Shane Oliver, Head of Investment Strategy & Chief Economist, AMP Capital, Australia

One word of caution for US investors on dividend taxation. The general dividend withholding tax rate for US investors (for both regular and retirement accounts) is 30%. However if the dividends paid by Australian companies are fully franked, the withholding tax rate is reduced to 15%.

Five Australian stocks are listed below with their tickers on the US markets and the current dividend yields for further research:

1.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 6.33%

Sector: Banking

2.Company: Australia and New Zealand Banking Group Ltd (ANZBY)

Current Dividend Yield: 6.29%

Sector:Banking

3.Company: National Australia Bank Ltd (NABZY)

Current Dividend Yield: 6.84%

Sector:Banking

4.Company:Commonwealth Bank of Australia (CMWAY)

Current Dividend Yield: 5.38%

Sector: Banking

5.Company: Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 5.68%

Sector:Telecom

Note: Dividend yields noted above are as of Dec 12, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long NABZY