Investors should invest in stocks for the long-term and not engage in shot-term trading.Long-term is measured in years and can be considered as at least five years. Trying to time the market is not a good idea for the majority of investors. There are not many people in the world who have successfully predicted the future movement of markets. For most retail investors the saying that it is the time in the market and not timing the market that is important still holds true today. Often quoted phrases like “Sell in May and Go Away”, October is the worst month for stocks, etc. do not mean anything and we should ignore them.

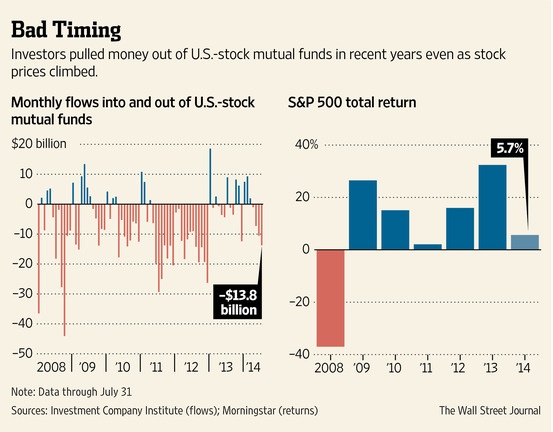

I recently across an interesting article in The Wall Street Journal by Morgan Housel on the mistakes investors make. He discussed the following three mistakes made by investors:

- Incorrectly predicting your future emotions.

- Failing to realize how common volatility is.

- Trying to forecast what stocks will do next.

Click to enlarge

Source: Three Mistakes Investors Keep Making Again and Again, The Wall Street Journal, Sept 12, 2014

Other than factors beyond one’s control, it is fear and greed that determine individual investors’ returns.Studies have proven over and over again that mutual fund investors’ return is usually lesser than the fund returns. This is because a fund return is calculated for a specific period from start to end such as a 5-year period but an individual investor’s return is based on when they get in and when they get out.So during the same 5-year period of the fund return an investor can get in and out many times and that will usually have an adverse impact on their returns.

The S&P 500 plunged to below 700 during the global financial crisis of 2008-09. Since then the index has more than doubled and closed at 1,886 on Friday. Those who completely sold out their holdings in early 2009 and moved to cash missed out on the strong rally.

So the main point is keep one’s emotion in check at all times and not let deviate from long-term goals during extreme volatility in markets.

Five large-cap stocks from developed Europe that investors can consider holding for the long-term are listed below for consideration:

1.Company: Total SA (TOT)

Current Dividend Yield: 4.80%

Sector:Oil, Gas & Consumable Fuels

Country: France

2.Company: Anheuser-Busch InBev SA (BUD)

Current Dividend Yield: 1.88%

Sector: Beverages

Country: Belgium

3.Company: Novo Nordisk A/S (NVO)

Current Dividend Yield: 1.87%

Sector: Pharmaceuticals

Country: Denmark

4.Company:BASF SE (BASFY)

Current Dividend Yield: 3.24%

Sector: Chemicals

Country: Germany

5.Company: Novartis AG (NVS)

Current Dividend Yield: 2.05%

Sector: Pharmaceuticals

Country: Switzerland

Note: Dividend yields noted above are as of Oct 17, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions