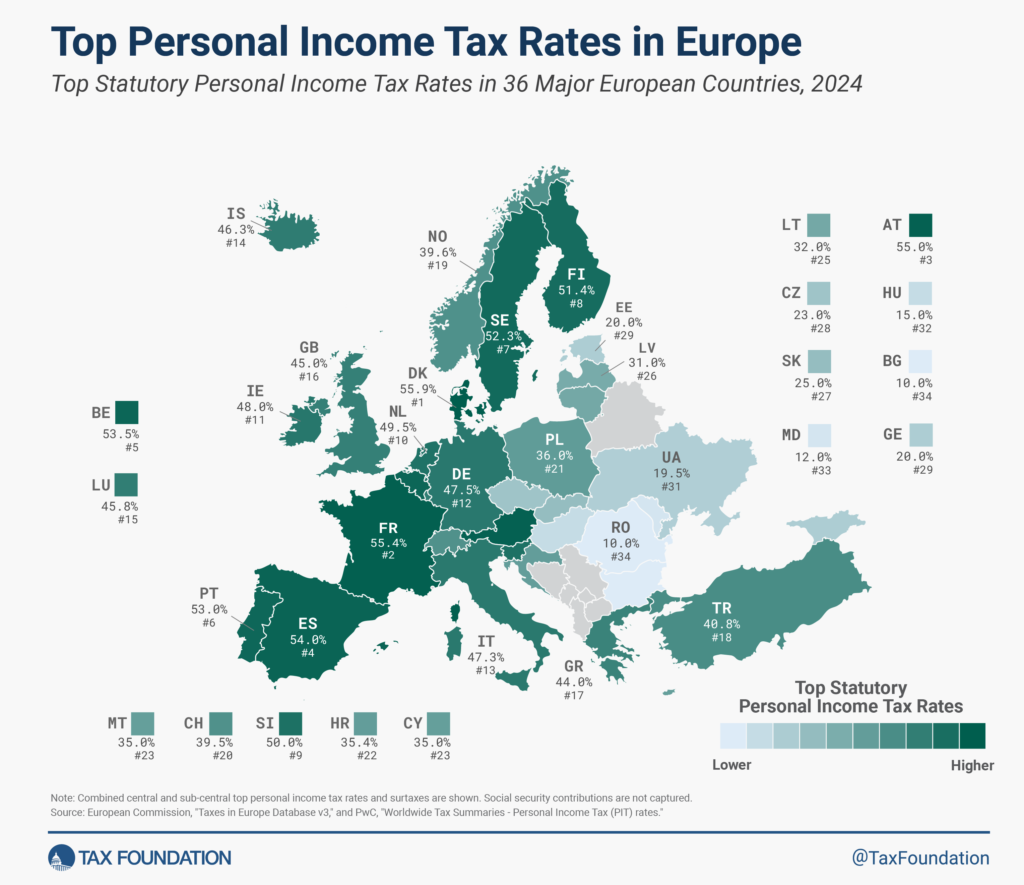

Personal Income Tax Rates in Europe widely. In most countries the personal income tax is progressive meaning higher income earners pay higher taxes and vice versa. According to the Tax Foundation, the Top Personal Tax Rate in Europe in 2024 is in Denmark, France and Austria in that order.

Click to enlarge

Source: Top Personal Income Tax Rates in Europe, 2024, Tax Foundation

The average personal income tax rate in Europe this year is 42.8%.

Bulgaria and Romania charge the lowest rate at 10% followed by Moldova.