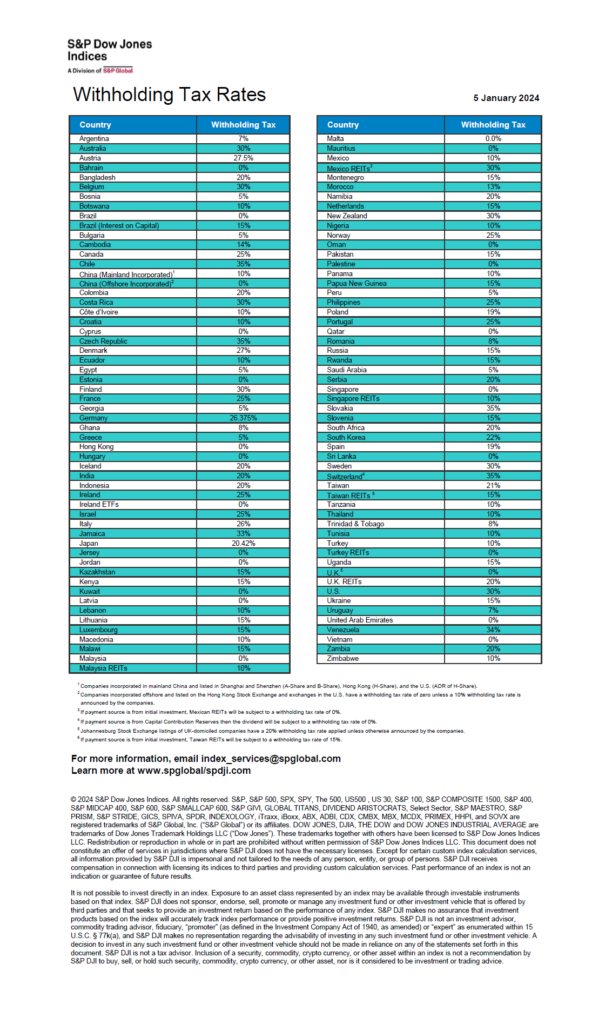

S&P Global has published the Dividend Withholding Tax Rates by Country table for 2024. This handy one-pager is a useful tool for investors that invest in foreign stocks. Dividends from most foreign stocks are subject to withholding taxes for Americans and hence it is important to keep track of the rates. Higher tax rates would reduce the overall net dividend yield.

From my post last year:

“Though the rate for Canada is noted as 25% in this table, this can be reduced to 15% in non-retirement accounts by submitting NR-301 form to Canada Revenue Agency (CRA). For stocks (excluding REITs) held in qualified retirement accounts such as IRAs, Canada does not withhold any dividends for US residents. So Canadian income equities are ideal for US retirement accounts.”

Click to enlarge

Source: S&P Global