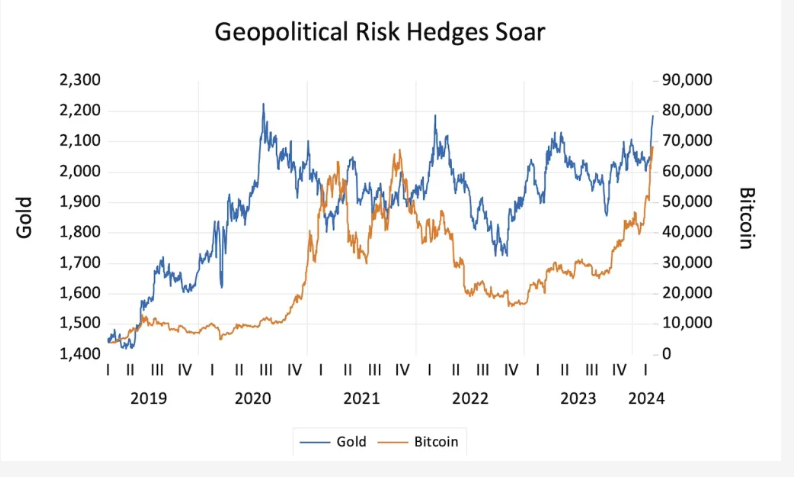

Oil prices are rising again. Brent prices for May delivery closed at $85.42 on Friday. Year-to-date prices have gone up by 12%. Higher oil prices has lead to higher gasoline prices at the pump. Earlier this month, OPEC announced the extension of production cuts through the end of this year. Geopolitical risks have not subsided and will continue to exist for the foreseeable future. Higher oil prices are generally beneficial to oil companies. Hence investors looking to gain exposure to the oil industry can consider adding oil stocks in a phased manner when equity markets turn volatile.

Ten large oil companies that investors can consider for further research are listed below with their current dividend yields:

1.Company: Exxon Mobil Corp (XOM)

Current Dividend Yield: 3.42%

Country: USA

2.Company: Shell PLC (SHEL)

Current Dividend Yield: 4.8%

Country: UK

3.Company: Chevron Corp (CVX)

Current Dividend Yield: 4.19%

Country: USA

4.Company: BP PLC (BP)

Current Dividend Yield: 4.55%

Country: UK

5.Company: TotalEnergies SE (TTE)

Current Dividend Yield: 4.7%

Country: France

6.Company: Eni SpA (E)

Current Dividend Yield: 6.28%

Country: Italy

7.Company: Equinor ASA (EQNR)

Current Dividend Yield: 13.71%

Country: Norway

8.Company: Ecopetrol SA (EC)

Current Dividend Yield: 14.0%

Country: Colombia

9.Company: ConocoPhillips (COP)

Current Dividend Yield: 3.48%

Country: USA

10.Company: Phillips 66(PSX)

Current Dividend Yield: 2.64%

Country: USA

Notes:

a) Dividend yields noted above are as of Mar 15, 2014. Data is known to be accurate from sources used. Please use your own due diligence before making any investment decisions.

b)For foreign companies listed above, dividend withholding taxes will reduce the dividend yields quoted.

Disclosure: Long EC