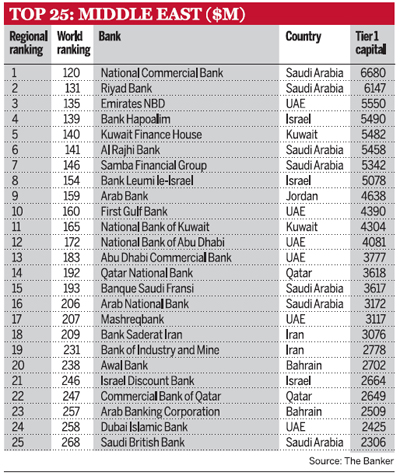

The list Top 25 Banks in the Middle East was published The Banker magazine last month. The National Commercial Bank of Saudi Arabia was the highest ranked bank in the region. But its Tier 1 capital fell 15% last year and it slipped 12 places to end at 120th spot in the world’s top bank rankings.The second rank was also held by a Saudi Arabian bank. Saudi Arabia-based Riyad Bank doubled its Tier 1 capital in 2008 to $6.1B.

The Top 25 Banks in the Middle East:

Source: The Banker

According to the magazine “The Middle Eastern banking sector has remained relatively isolated from the worst of the crisis in the financial markets, but its banks are being hit indirectly by the wider global economic downturn and plunging commodity prices, in particular oil.”