Special report: Are the days of “big gold” over? As cash pressures mount, gold majors move to mine the markets, which are proving more lucrative than the mining of gold.

Built on a Lie – The Fundamental Flaw of Europe’s Common Currency

A new forecast from RBC Economics says Canada’s economy is poised for real GDP growth of 3.1 per cent this year and 3.9 per cent in 2011. Canadian economy ready for major rebound, RBC says

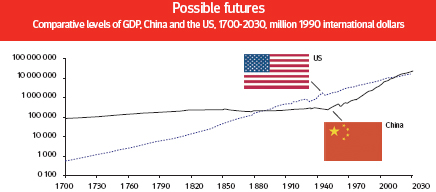

Debt doom ahead US Congressional Budget Office figures, showing how horrendously large the national debt will become, indicate that the United States economy will be 71% bigger within 10 years. If everything costs twice as much by then, why not? And the only people better off will be those who are buying gold now!!!

China showing signs of overheating

CHINA’S industrial output has hit a five-year high, adding to the case for the Government to pare back stimulus measures.