Property investors could get burnt again

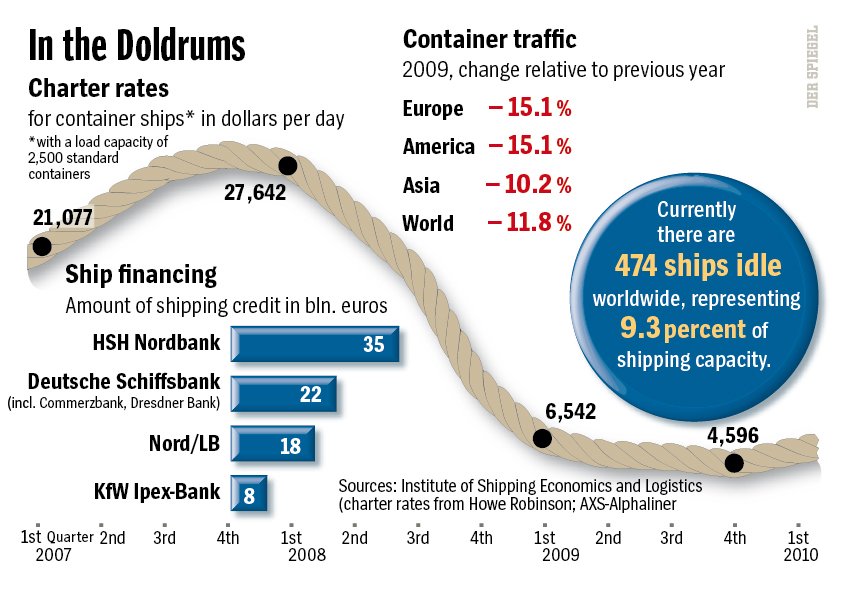

German Shipping Faces Wave of Financing Problems

Red-hot housing market to cool off

Health-Care Cost Lies Make Us Sing the Blues

Bright outlook for Australia – RBA

The Dollar and the Deficits: How Washington Can Prevent the Next Crisis

Britain Resists Austerity to Cure Budget Woes

Post-Apocalyptic zombie finance

Source: De Speigel