The 10 most profitable publicly-listed Indian companies that appear in the Forbes Global 2000 list for 2010 are listed below:

[TABLE=504]

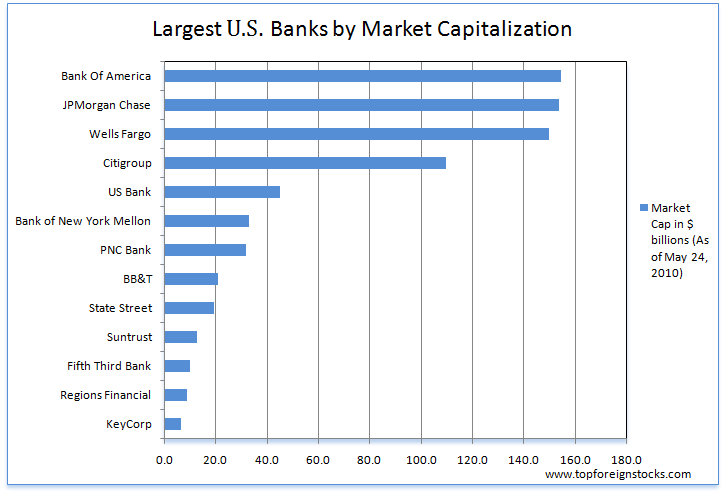

Except IT outsourcing firm Infosys Technologies (INFY), none of the other companies trade on the US markets. The most profitable company in India is the state-owned Oil & Natural Gas Corp. which made$3.86B last year. State Bank of India, India’s largest bank is also state-owned and was ranked at number three. It must be noted that Indian banks such as State Bank of India and ICICI Bank(IBN) have a long way to go before they can become global players. For example, though banks in India operate in different dynamics than their western counterparts, profits earned by Indian banks are low compared to international banks. For example, State Bank of India’s profit of $2.13B for the full year pales in comparison to Bank of America’s profit of $4.2B just in the first quarter of 2009.

ETFs to invest in India:

iShares S&P India Index Fund (INDY)

PowerShares India Portfolio (PIN)

WisdomTree India Earnings Fund (EPI)