Seadrill, a leading Norwegian offshore drilling company started trading on the NYSE on April 15th with the ticker SDRL.

Seadrill, a leading Norwegian offshore drilling company started trading on the NYSE on April 15th with the ticker SDRL.

From the corporate site:

“The company operates a versatile fleet of 40 units for operations in shallow to ultra-deepwater areas in harsh environment and benign environments,

* Semi-submersibles

* Deepwater drillships

* Jack-ups

* Semi-tender rigs

* Tender rigs

Seadrill has some 7,500 skilled and highly competent employees, representing over 40 nationalities, operating in 15 countries on five continents.”

In the first quarter 2010, the net income net income was US$217M from total revenue of $853M. The company won new contracts and contract extensions totaling $2.7B.

Some interesting facts about Seadrill:

- 2nd largest offshore driller based on EV

- 2nd largest ultra-deepwater fleet

- Most modern offshore drilling rig fleet

- Has operations in Gulf of Mexico, Africa, Brazil, Southeast Asia, Norway and South Korea.

- The order back log stands at $10.8 B

- Top customers include Petrobras(PBR), Exxon Mobil(XOM), Total(TOT), Chevron(CVX), Statoil(STO), etc.

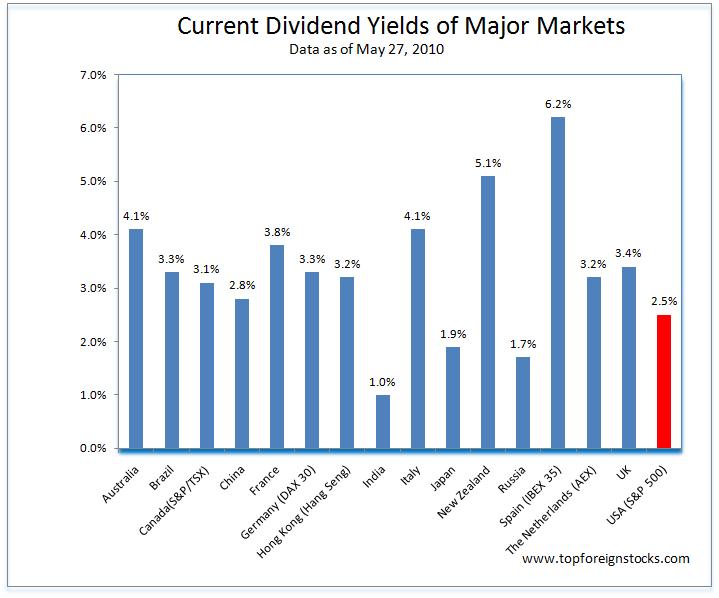

The stock closed at $27.18 on the first day of trading. On May 28th, Seadrill ADR closed at $20.68%. The current dividend yield is 7.98% and the total number shares outstanding is 399 million.