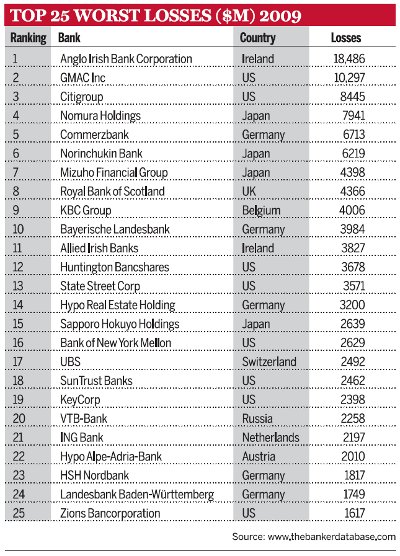

The graphic below shows the top 25 worst global banks based on losses:

Source: The Banker

Except VTB-Bank of Russia, all the losers in this list are from Europe, the U.S. and Japan. None of the major emerging market banks appear in this list which confirms their strength during the global financial crisis.