The 10 largest publicly-listed Belgian companies based on sales for 2009 that appear in the Forbes Global 2000 list for 2010 are listed below:

[TABLE=566]

Related ETF:

iShares MSCI Belgium Index Fund (EWK)

The 10 largest publicly-listed Belgian companies based on sales for 2009 that appear in the Forbes Global 2000 list for 2010 are listed below:

[TABLE=566]

Related ETF:

iShares MSCI Belgium Index Fund (EWK)

The 10 largest publicly-listed Danish companies based on sales for 2009 that appear in the Forbes Global 2000 list for 2010 are listed below:

[TABLE=569]

According to IMF estimates, the Brazilian economy is projected to grow 7.5% this year and 4.1% in 2011. Among emerging markets Brazil has recovered strongly from the financial crisis and the economy continues to grow. The following five charts show some of the reasons for the continued strength of the Brazilian economy:

Click to Enlarge

1) Ranking in Foreign Direct Investment (FDI)

2) Diversification of Exports

3) Jobs creation

4) Unemployment rate

5) Comparison of Unemployment Rate between Brazil and other countries

Source: Banco Central Do Brasil

It is surprising to see that the unemployment rate in Brazil is lower than most the rate in most developed countries and also other emerging countries such as India. From 2003 to 2009, about 36.0 million Brazilians have entered the middle class. Between 2010 and 2014 another 36.0 million is estimated to join the middle class. The level of poverty as a percentage of total population has fallen by nearly half to reach 15.3% in 2009. As a result of the incredible economic growth in recent years, the income inequality as measured by the Gini index has declined from 0.566 in 1998 to 0.509 last year.

Related ETF:

iShares MSCI Brazil Index Fund (EWZ)

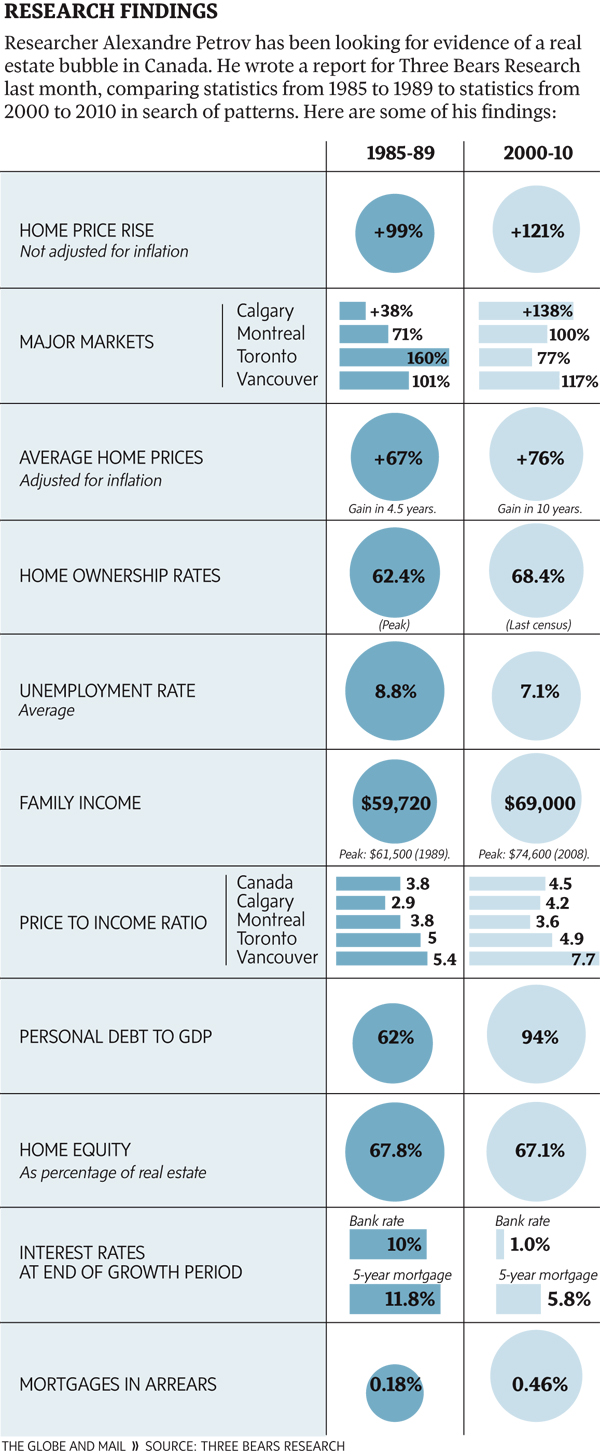

Here is an interesting graphic on the housing market in Canada:

Source: The long shadow over Canada’s housing market, The Globe and Mail

Asian banks in general have higher capital adequacy ratios than banks in Europe and the U.S. Large banks in Indonesia, Singapore and Taiwan have total capital adequacy ratios exceeding 15%.

Source: REGIONAL ECONOMIC OUTLOOK, Asia: Consolidating Recovery, Building Sustainable Growth,

IMFSurvey Magazine

Capital adequacy ratio(CAR) “is a ratio of a bank’s capital to its risk”. As Chinese banks continue to grow it is interesting to note that their CAR is lower than other Asian countries such as India, Japan, Korea, etc.Similarly the Core Tier 1 ratio of Chinese banks is also low.