The US equity market is in the grip of a brutal bear. The summer rally seems long ago and may have pulled additional investors who though the bear market was over. Inflation is still raging and the Federal Reserve has made it clear that they will not rest until soaring inflation is tamed. This week’s another 0.75 percentage increase in interest rates is another reminder of their plan in action.

According to the Labor Department, the consumer price index rose 8.3% in August relative to the same month last year. The actual inflation rate faced by consumers is much higher in most cases. From airfares to cars to insurance to food and everything in between we are learning how high inflation rate hurts. Up until a few years inflation was mostly non-existent in the US other than few select sectors such as college tuition or healthcare for instance. Now inflation is across the board. That has got the attention of the Fed which until recently was claiming it was just transitory.

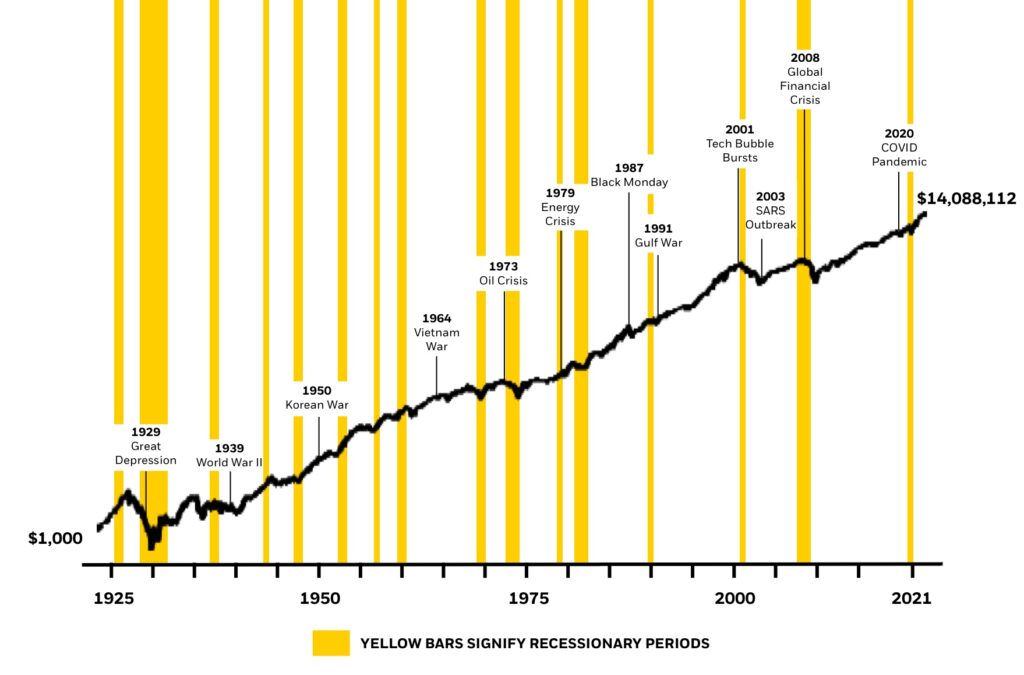

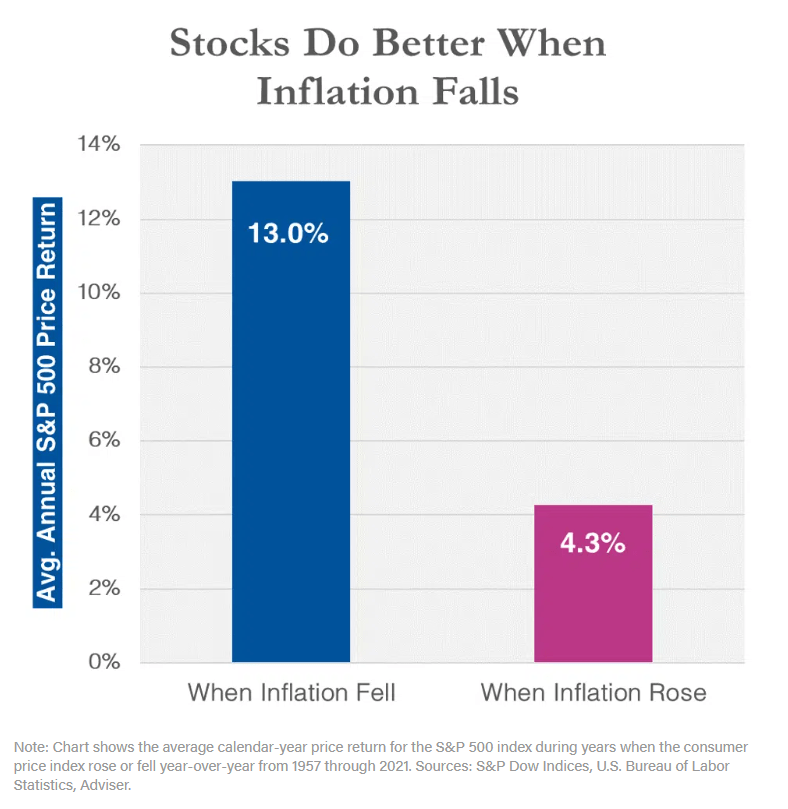

Many investors are wondering whether inflation is good or bad for stocks. One could argue that inflation could help stocks since when companies raise prices they generate higher profits. But the problem with this argument that not all companies can jack up prices to what they want without consumers noticing it. In addition, since the US economy is a consumption driven economy consumers can also simply avoid or reduce their purchases if prices become too high. According to a research note posted by Jeffrey DeMaso at Adviser Investments, the S&P 500 has performed much better during times of falling inflation than during times of rising inflation as shown in the chart below. The average annual S&P 500 return, since its inception in 1957 to 2021 was 13% when inflation fell and just 4.3% when inflation rose.

Click to enlarge

Source: Chart of the Week: Inflation Rates and Stock Prices, Adviser Investments

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No positions