Canada’s benchmark S&P/TSX Composite Index down 13% so far this year. The S&P 500 on the other hand is in a bear market with a decline of over 22%. Booming commodity markets especially oil earlier in the year benefitted Canada. It remains to be seen if the TSX Composite holds up well thru the end of the year with a global recession looming on the horizon.

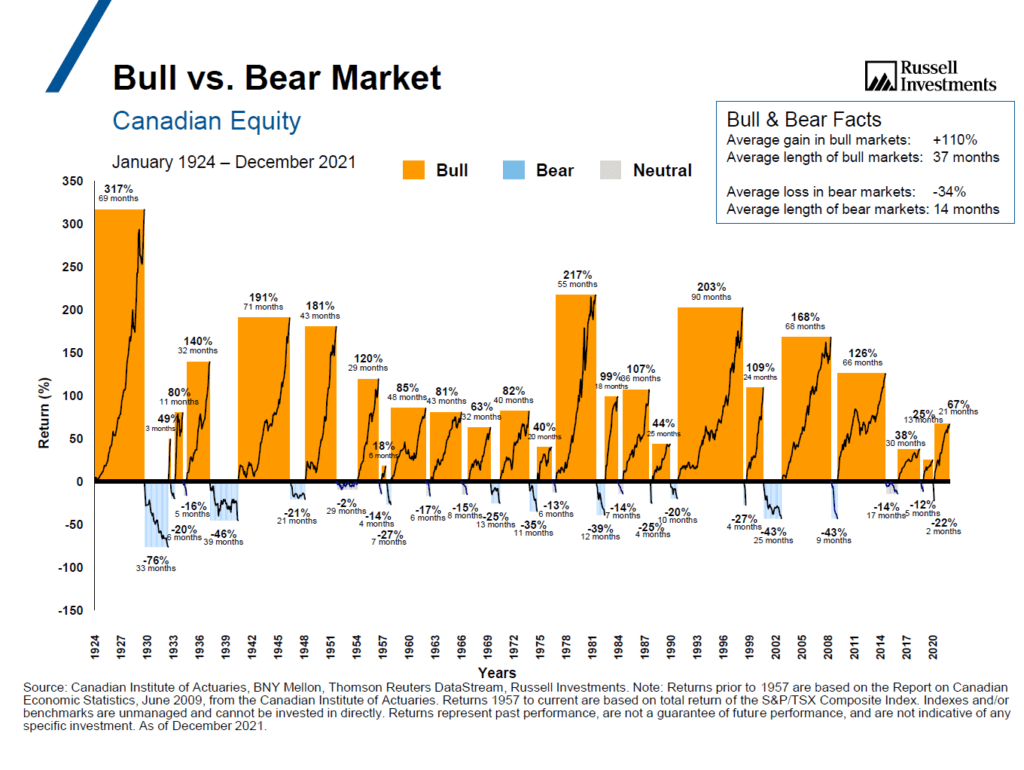

As in other developer markets, bull markets have been longer than bear markets in the Canadian context also. Data from 1924 to 2021 show that the average bull market lasted for 37 months and returned 110% while the average bear market length was 14 months with a loss of 34%.

Click to enlarge

Source: Russell Investments

Related ETFs:

Disclosure: No positions