The huge rise in the middle-class population in emerging countries such as India, China, Brazil, etc. is leading to strong growth in automobile sales. For example, 13.6 million cars, trucks and other vehicles were sold in China in 2009 making it the largest auto market in the world ahead of the U.S. This figure represents a 46% increase from the previous year. Compared to China, just 10.4 million vehicles were in 2009 in the U.S. At the beginning of this year, four million private cars clogged the streets of Beijing.In the first 11 months of 2010, automakers in China shipped a total of 16.4 million vehicles to dealers representing a 34% increase from 2009, according to China Association of Automobile Manufacturers (CAAM).

Similar to China, Brazil overtook Germany to become the fourth biggest car market in the world. By the end of 2010, a total of 3.45 million vehicles are forecast to have been sold in Brazil. This is about 10% higher than 2009. With a population of 192 million Brazil has a low vehicle density of just one vehicle per seven residents compared to much higher levels in the developed world. The top three car companies in Brazil are Fiat (FIATY), Volkswagen(VLKAY) and General Motors (GM).

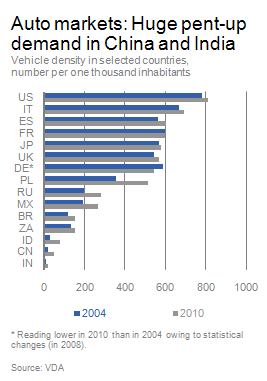

The chart below shows the vehicle density in select countries:

Source: Deutsche Bank Research

The U.S. ranks first in the world with over 800 vehicles per 1,000 inhabitants followed by western European countries and Japan. With developed countries having about two-thirds of the total global vehicle stock, the car market in those countries is becoming saturated.

From the Deutsche Bank Research report:

China and India are at the lower end of the list of large economies in terms of vehicle density. In the US, for instance, the ratio of cars to inhabitants is fifty times higher at present than in India. Nonetheless, the emerging markets are catching up quickly. The number of vehicles per capita in India, for instance, rose by more than 60% between 2004 and 2010, while China registered an increase in excess of 150% in the same period. The world’s two most populous nations are very likely to see vehicle density double during the current decade. In absolute terms this would mean an increase in the combined stock of motor vehicles in China and India of more than 135 million units. This would correspond roughly to the current joint vehicle stock of Germany, France, Italy, the Netherlands and Belgium.

The explosive growth in auto sales in emerging markets should immensely benefit companies in the infrastructure space in these countries. Hence in order to profit from the growth of auto markets investors may be better off gaining exposure to companies engaged in building transportation infrastructure than investing in auto makers. This is because the auto industry is has a low return on equity and shareholders of many auto companies have not enjoyed high returns. In fact companies such as the American auto giant General Motors went bankrupt and is now recovering after a huge government bailout.

Related ETFs:

EGShares India Infrastructure ETF (INXX)

EGShares Brazil Infrastructure ETF (BRXX)

EGShares China Infrastructure Index Fund (CHXX)

iShares S&P Emerging Markets Infrastructure Index Fund (EMIF)

PowerShares Emerging Markets Infrastructure Portfolio (PXR)

Disclosure: No Positions