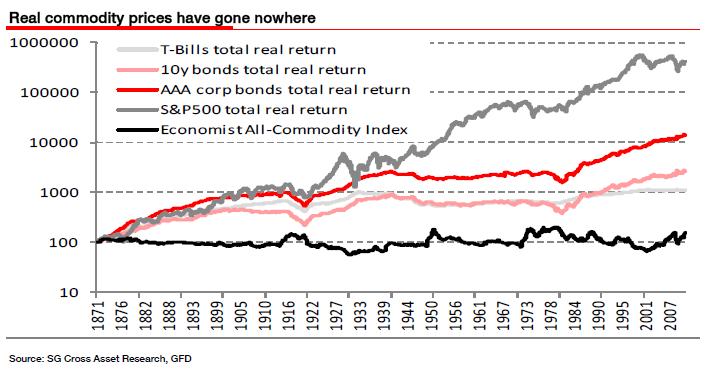

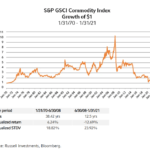

In recent years ordinary investors have been attracted to all types of commodities such as gold, silver, oil, natural gas, etc. primarily due to the poor performance of equities and also the availability of easy avenues to invest in them such as ETFs. Despite all the glamor of investing in commodities, equities are still the best long-term investments. The chart below compares the performance of real commodities and other asset classes since 1897:

Click to enlarge

Source: Via FT Alphaville Blog

Clearly the S&P 500 has had a much higher growth than bonds, T-bills and commodities in the time period shown. Real commodity prices on the other hand have gone nowhere.Unlike stocks, commodities are extremely volatile and are not suited for all investors.Though the time period shown in the chart is over a century, commodities are still not the best investment option even in shorter durations as confirmed by the rise and fall in the commodity prices with the overall trend pretty much flat.

Related ETFs:

SPDR Gold Trust ETF (GLD)

iShares Silver Trust ETF (SLV)

United States Natural Gas Fund (UNG)

United States Oil Fund (USO)

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions