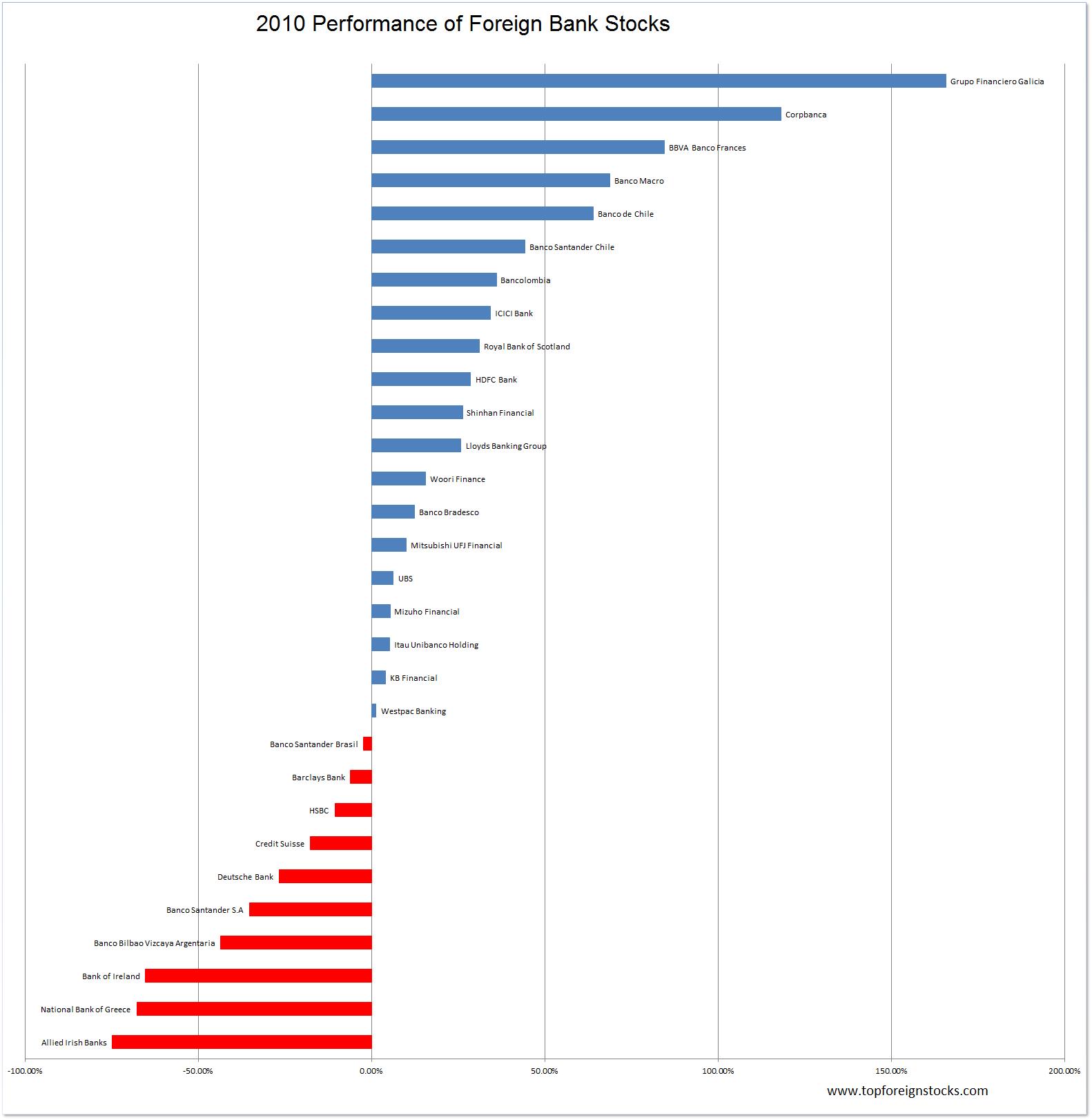

The chart below shows the performance of all the exchange-listed foreign bank stocks for 2010:

Click to enlarge

Due to the sovereign debt crisis, European banks were some of the worst performers last year. Irish banks were crushed again as Ireland was on the verge of total collapse. Allied Irish Bank(AIB) was nationalized in December with a capital injection of another 3.7 billion Euros.Other Western European banks are still struggling as the 2010 returns shows above. Investors are ignoring these bank stocks despite the sharp fall in prices as the fear of the unknown is too high especially with their exposure to the real estate sector and cross-border loans to banks. Stress tests that were conducted by Europeans failed to raise investors’ confidence.

The five best performing banks were from Argentina and Chile. The economy of Argentina has stabilized in recent years and banks are performing well. Similarly Chile rode the commodity boom last year especially due to the huge demand for copper. In spite of the earthquake that affected much of the country, the economy recovered and continues to show strength. Hence Banco de Chile (BCH)Â and Banco Santander Chile(STD) shot up nicely for the year. Unlike Chile and Argentina, Brazilian banks yielded average returns in 2010.

Disclosure: Long BCH, STD, ITUB, BBD, LYG, BBVA, RBS