Many investors tend to avoid airline stocks since the industry suffers from low earnings due to various factors such as regulations, fluctuations in fuel prices, labor issues, business disruptions due to weather like snow, volcano eruptions, flawed business models, incompetent management, etc. This is especially true in the U.S. where the industry is highly concentrated with a few players. In fact, the majority of airlines in the U.S. are not profitable.While the airline industry in developed countries are experiencing stagnant to moderate growth, local airlines in emerging markets and airlines that are well positioned to serve this market are enjoying tremendous growth due to the rising popularity of air travel.

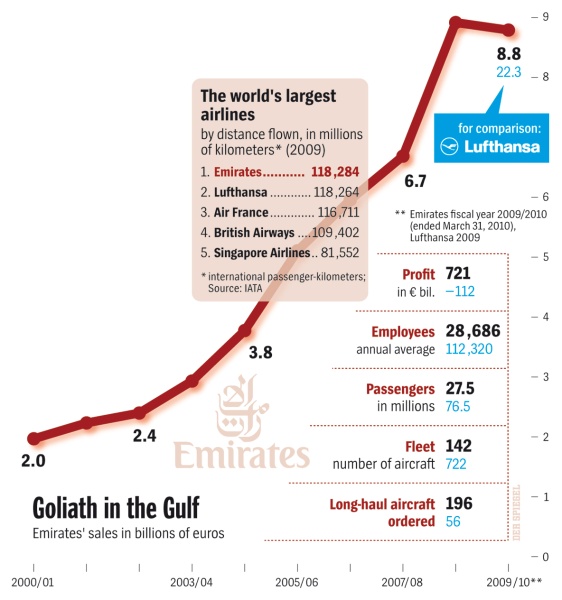

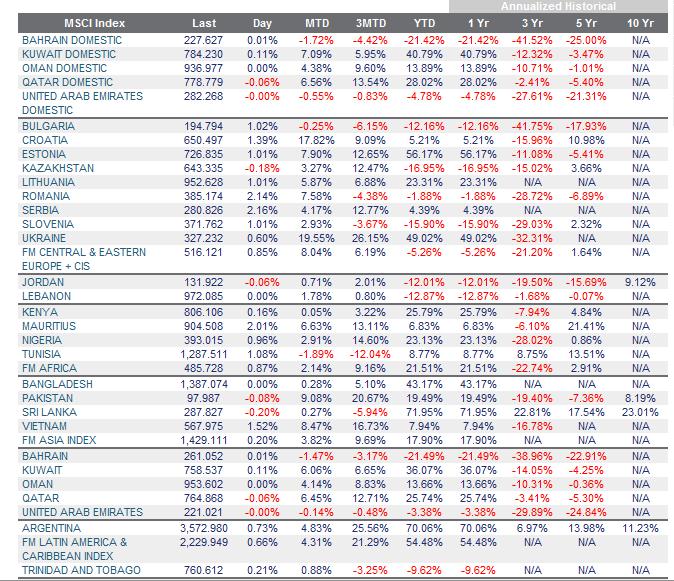

A recent article in the Der Speigel discussed the success of the Dubai-based airline Emirates. This airline has become the world’s largest airline based on distance flown and is also highly profitable. To serve the demand in its operating territory efficiently Emirates already has 15 of the massive Airbus A380s jets and has another 75 on order. Located between the emerging markets of Asia, Africa and Europe, Dubai is also trying to position itself as a major global hub for air travel. Dubai is building the world’s largest airport that will cover 54-square mile in the desert with the capacity to handle 160 million passengers each year.

Source:Â Der Speigel

From the article:

In the past, the industry’s self-appointed top dogs on both sides of the Atlantic made a good living off the situation — one that was even perhaps a bit too good.

Indeed, since globalization has massively increased the significance of India and China, having connections to those countries has become all the more important. “Where 10 years ago only one person wanted to travel,” Clark says, “now you have 10,000.” And, for all of these new clients, Dubai enjoys a very central position. For example, Nigerian traders take flights connecting through Dubai to reach Shanghai or Hong Kong, where they purchase low-cost goods that they then resell at a profit in their home countries. And, for their part, the Chinese are extremely interested in making business contacts in Africa because they want to benefit from the continent’s wealth of raw materials. Indeed, even Brazilian companies would like to see more and better flight connections.

“In the 21st century,” Clark predicts, “the epicenter of global traffic flows will shift — completely and forever.”

While large industrial corporations recognized the effects of globalization early on and established a foothold for themselves in the emerging economies, Europe’s formerly state-owned airlines were initially slow to react. Until recently, they preferred to focus on taking over troubled competitors or forging alliances with their competitors.

The rigid legal system also blocked airline efforts to expand internationally. Indeed, even today, bilateral agreements between countries stipulate in painstaking detail which airline can fly where, how often and with which aircraft.

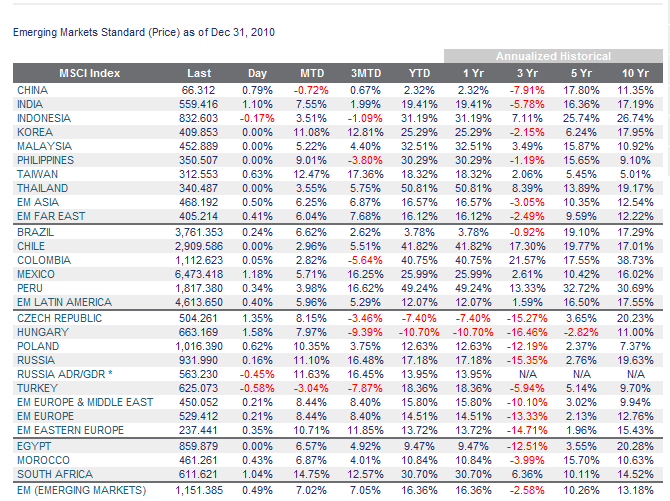

Foreign airline stocks that trade on the U.S.-organized exchanges are listed below:

1.Ryan Air (RYAAY)

Country: Ireland

2.Lan Airlines(LFL)

Country: Chile

3.Gol Linhas Aereas Inteligentas(GOL)

Country: Brazil

4.China Eastern Airlines (CEA)

Country: China

5.China Southern Airlines (ZNH)

Country: China

Some of the foreign airline stocks that trade on the OTC markets are:

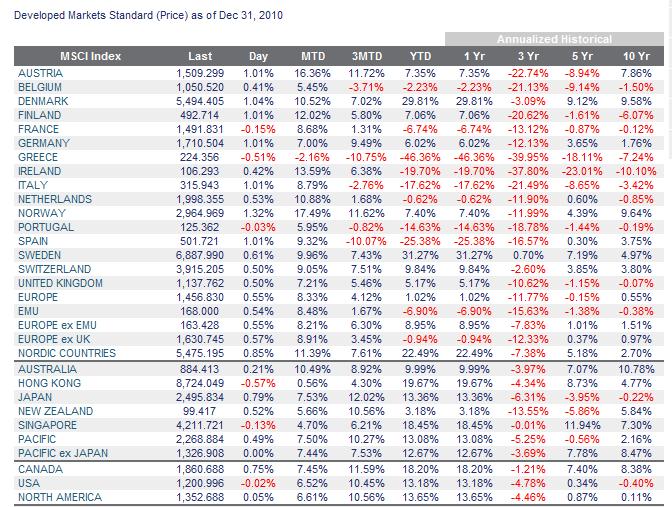

1.Deutsche Lufthansa (DLAKY)

Country: Germany

2.Cathy Pacific Airways (CPCAY)

Country: China

3.Air China (AIRYY)

Country: China

4.Air France-KLM (AFLYY)

Country:France

5.Japan Airlines (JALSQ)

Country: Japan

6.All Nippon Airways (ALNPY)

Country:

7.British Airways (BAIRY)

Country: UK

8.Easyjet PLC (ESYJY)

Country: UK

Stocks of European airlines such as British Airways, Deutsche Lufthansa, British Airways and Air France-KLM can be avoided for the reasons discussed above. However Easyjet and Ryan Air which are low-cost airlines based in Europe are growing by adding more routes and competing aggressively with the major carriers. Hence they offer potential investment opportunities.

Disclosure: No Positions

Kai Tak Airport Landing, Hong Kong