US stocks are squarely in the bear market with the S&P 500 down over 20% so far this year. There is no place to hide and take shelter as most sectors are down. One of the few sectors that has performed well is the energy sector. Energy stocks are up by 29.2% YTD. Crude has soared by over 40% and natural gas is also a winner with a rise of 45.4% year-to-date.

The demand for oil and other energy commodities has shot up and continues to remain strong with the end of the Covid-19 pandemic. Despite high prices consumers are traveling for example. The Russia-Ukraine war has also made the situation worse. Oil prices are unlikely to go down significantly until the war ends. Releasing small amount of oil from the Strategic Petroleum Reserve (SPR) and cutting federal taxes are all for PR purposes and is not going to help take the price of gasoline to pre-pandemic levels.

With that said, most of the oil stocks have performed very well in this brutal market. For example, US energy giant Exxon Mobil (XOM) has increased by 38%. After reaching as high as $104 the stock is currently trading at over $87. Similarly Chevron(CVX) and ConocoPhillips(COP) have risen by 23% and 24% respectively.

Though US energy stocks are up by double digit percentage points, not all exchange-listed foreign oil producers have done well. For instance, Norway’s Equinor (EQNR) has gone up 28% YTD.

The Year-to-Date returns of Foreign Oil & Gas Producers trading on the US exchanges are shown below:

| S.No. | Company Name | Ticker | Stock Price (Ending July 1,2022) | Yeat-to-Date Change (%) | Country |

|---|---|---|---|---|---|

| 1 | Vista Energy S.A.B. de C.V. | VIST | $7.48 | 40.34% | Argentina |

| 2 | Sasol | SSL | $21.68 | 32.20% | South Africa |

| 3 | Equinor | EQNR | $33.83 | 28.48% | Norway |

| 4 | Transportadora de Gas del Sur | TGS | $5.22 | 17.57% | Argentina |

| 5 | PetroChina | PTR | $47.35 | 7.10% | China |

| 6 | Petroleo Brasileiro-Petrobras | PBR | $11.76 | 7.10% | Brazil |

| 7 | TOTAL | TOT | $52.83 | 6.81% | France |

| 8 | BP | BP | $28.28 | 6.20% | United Kingdom |

| 9 | China Petroleum & Chemical | SNP | $45.14 | -2.95% | China |

| 10 | YPF | YPF | $3.32 | -13.09% | Argentina |

| 11 | Ecopetrol | EC | $11.08 | -14.04% | Colombia |

| 12 | Eni | E | $23.72 | -14.21% | Italy |

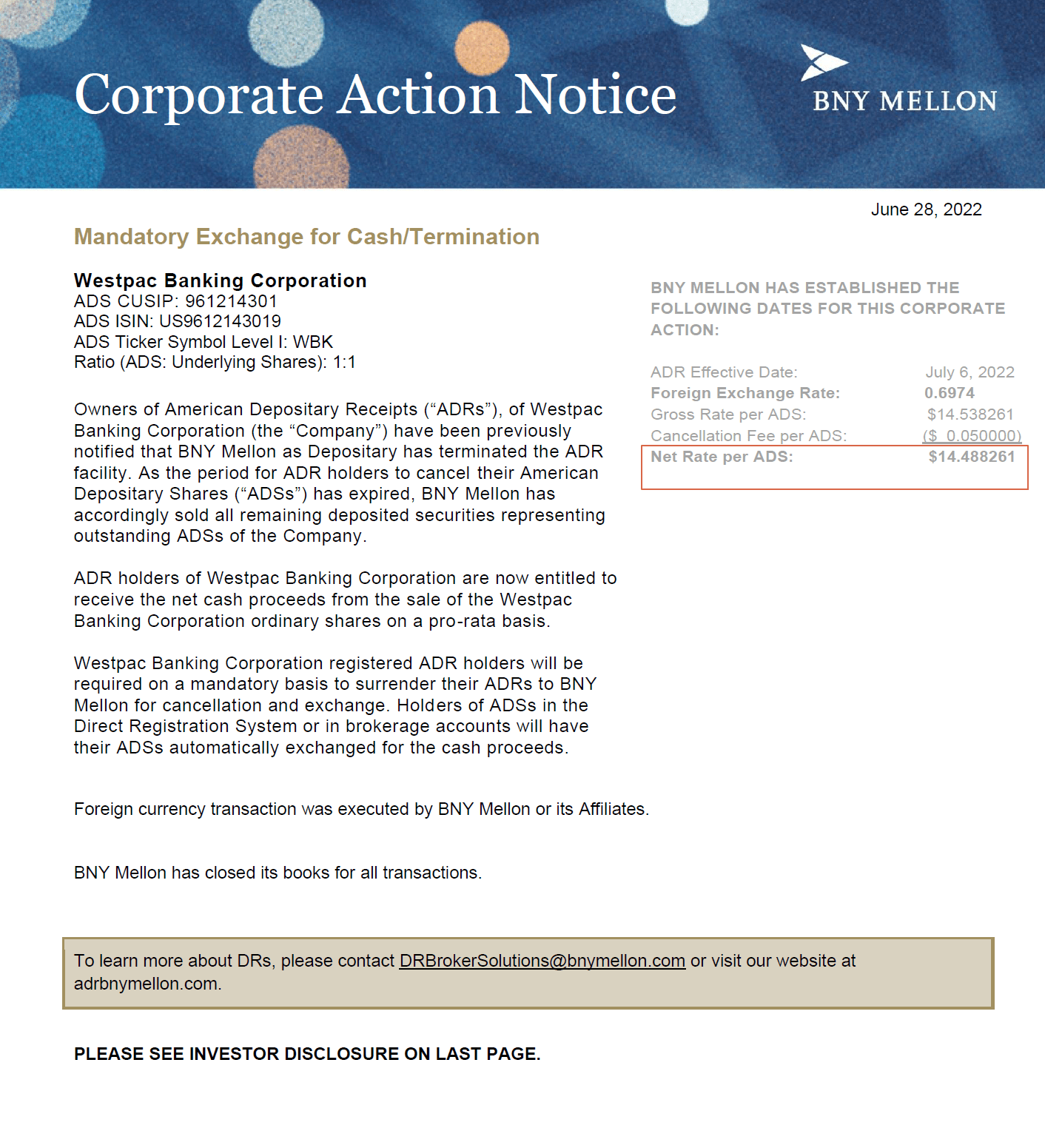

Source: BNY Mellon

Industry leaders such as Total and BP have had average returns so far this year. Political risk had led investors to flee Colombia’s EcoPetrol(EC) since the country elected its first leftist President Gustavo Petro.

From an investment perspective, the time to buy oil stocks was last year. However investors looking to add foreign oil stocks can keep an eye on the above list and look for attractive entry points.

Disclosure: Long EC