Since the start of the global financial crisis of 2008, most of the developed countries have bailed out distressed banks with taxpayer funds. The U.S. government allows the failure of small and tiny banks but bails out large and TBTF banks by pouring billions in bailout funds with programs such as the now-forgotten TARP program.

The small country of Denmark has been plagued by bank failures in the past three years due to their over exposure to the real estate industry and inability to obtain funding from foreign investors. However the Danish government refuses to rescue the distressed banks. Instead it has followed procedures to encourage consolidation in the industry with the restructuring of the troubled banks. Only the largest creditors and depositors have been forced to take the losses when banks failed. Ordinary depositors are protected by a deposit-guarantee fund created by the industry. The Danish banking sector is set for consolidation by 2013 according to a Bloomberg report.

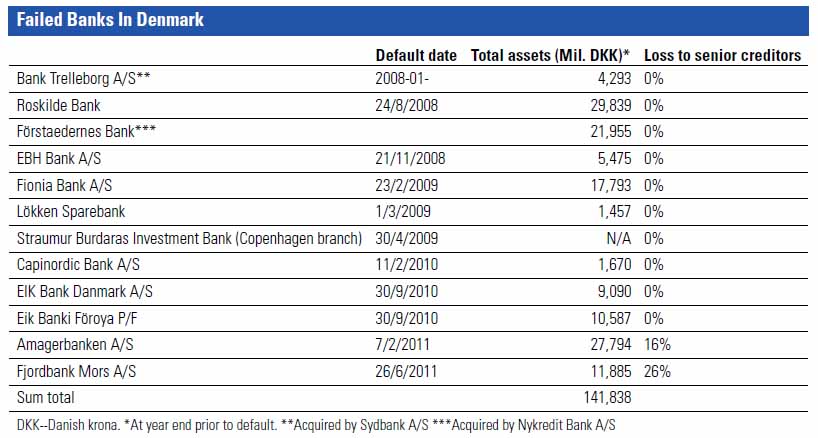

Denmark has about 130 banks and so far 12 banks have failed. The failed banks are listed below:

Click to enlarge

Courtesy: Zero Hedge

In a report titled “Further Bank Failures Likely In Denmark”, S&P stated last month that 15 more Danish banks could fail this year.

Due to the current policies of the state, the Danish banking industry will suffer in the short-term , but in the long-run it should become healthier as consolidation leads to fewer and stronger banks and the weaker banks are eliminated. This is a smart strategy compared to the ones followed in other developed countries where “zombie” banks are allowed to survive.

In the U.S. three of the large Danish banks – Danske Bank(DNSKY), Jyske Bank(JYSKY) and Sydbank A/S (SYANY) trade on the OTC market as unsponsored ADRs.

Source: CEIC Macro Watch, Europe and Central Asia

Disclosure: Long DNSKY