Kazakhstan became an independent country in 1991 after the breakup of the Soviet Union. It is the ninth largest country in the world and is bigger in size than Western Europe.

Unlike other natural resources-based economies, Kazakhstan is unique in that 99 of the 110 elements in the Periodic Table of the Elements are present in the country. Oil, gas, uranium, zinc, tungsten, barium, silver, lead, chrome, copper, fluorites, molybdenum, and gold are some of the resources that are currently being extracted from the land. In fact, the country’s vast mineral resources is estimated to be valued at over US$46.0 Trillions.

As an investment destination Kazakhstan is the wild west of the frontier markets and is slowly gaining the attention of international investors. Kazakh companies are not yet easily accessible to foreign investors as most of them are not traded on the major global exchanges. Fellow blogger and fund manager Roger Nusbaum has written about the country a few times. From one of his article last month:

The email in question shared news that many state owned companies will soon be sold into the market in a similar manner as many of the large Chinese companies, at least that is how I read it. Some companies mentioned were Air Astana, KEGOC which operates the electric grid, KazTransOil an oil pipeline company, KazTransGas a gas pipeline company, Kazmortransflot a shipping company, Samruk-Energo which generates power, Kazakhstan Temir Zholy a railroad operator and Kazatomprom a uranium miner. There are also a few materials companies that have been trading on other markets for a while with Kazakhmys (KZMYF) the one name most likely to be familiar. Kazakh Telecom appears to have a listing in France, but not on the US pinks, but it appears to have not traded since February. Kazmunaigas is also included in the announcement but it has shares trading on the AMEX; they’ve not done too well.

The ETF provider Global X filed for a country fund for Kazakhstan in July. But it is not clear when the ETF will actually be listed.

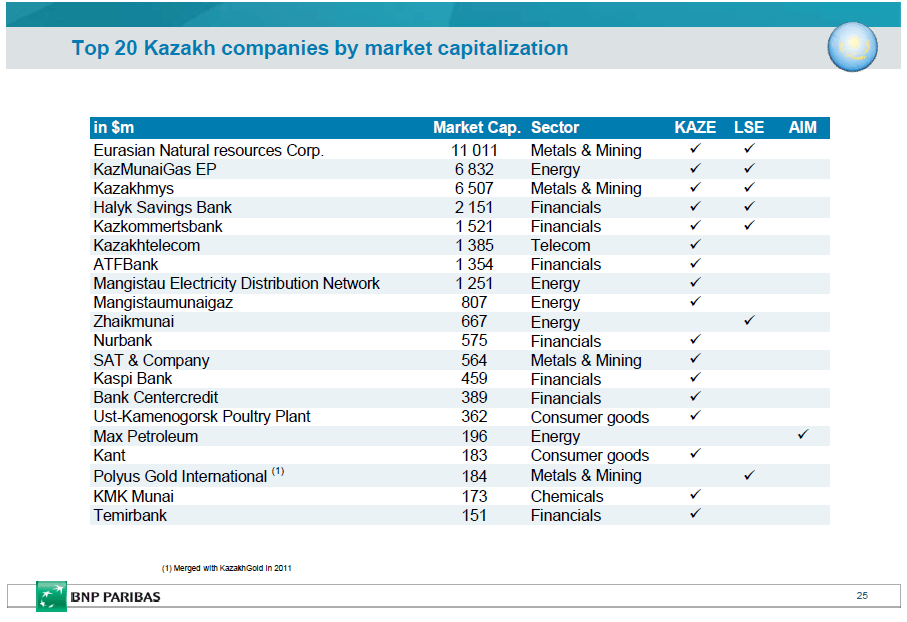

The Top 20 Kazakh Companies by Market Capitalization

Click to enlarge

Source: The attractiveness of the Kazakhstan Market, BNP Pribas

Two of the above companies trading on the London Stock Exchange(LSE) are Eurasian Natural Resources Corporation PLC (ENRC.L) and Kazakhmys PLC (KAZ.L). Polyus Gold International Limited GDR trades on the pink sheets under the ticker PLZLY.PK.

Related Links:

Kazakhstan Stock Exchange (KASE)

Also checkout:

- The Components of the Kazakhstan KASE Index (TFS)

- The Full List of Kazakhstan ADRs

- The Complete List of Kazakhstan GDRs

Disclosure: No Positions