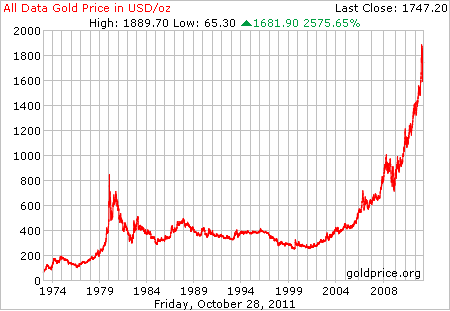

The price of Gold has soared in recent years and reached record highs earlier this year. In the past few months the price has stabilized slightly. On Friday (10/28/11) the spot price for gold closed at $1,743.40 according to Kitco. In the past 20 years, gold has returned an incredible 2,575% as shown in the chart below:

Click to enlarge

Source: www.goldprice.org

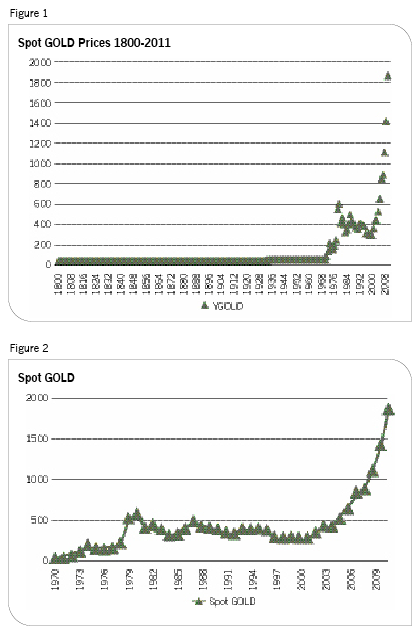

Despite the dramatic rise of prices in recent years, for much of the recorded history gold prices languished. For the period from 1800 to 1933 gold prices remained flat at around $20 per troy ounce according to an article titled Gold-The Fear Index by Somnath Basu in the Financial Advisor magazine.

The following charts show the long-term historical prices of gold:

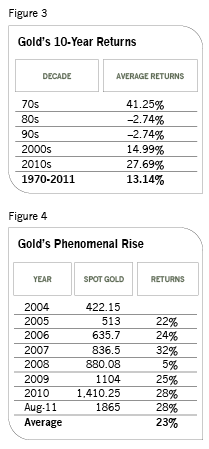

Somnathu notes that it was only after the Bretton Woods agreement was dismantled in 1967 and globalization began, the traditional global economic order collapsed and the precious metal started its first phase of growth. The following chart shows Gold’s 10-year returns and annual returns for the past few years:

Source: Gold – The Fear Index, Financial Advisor magazine

From the article:

Gold is a mirror. Its price gauges global economic fear. Fear of uncertainty, fear of losses and fear of poverty. As long as this fear remains in this world, the new gold standard will continue to reflect the fear standard. The index of fear!

The author concludes that “As long as global markets remain volatile and investor fears grow, gold will continue to increase in price.” I agree with the author’s conclusion. However it must be noted that investing in gold is not a bullet-proof strategy especially for long-term investors and income-seeking investors such as retirees. This is because gold does not pay any income such as dividends paid by equities or interest paid by bonds and the metal’s price is determined purely based on speculation. For example, the demand for gold continues to remain strong in India – the world’s largest gold consuming country, China, etc. But that does not mean the demand will not dimish at higher prices unless income rises at the current pace in those countries. So if the demand decreases global gold prices will fall. Hence investors should only allocate a small portion of their portfolio assets to gold and the majority of assets should still be invested in stocks and bonds.

Related ETF:

SPDR Gold Shares ETF (GLD)

Disclosure: No Positions