Utility stocks are generally considered to be defensive stocks. However in recent years they have been volatile and many have not recovered fully from the March 2009 lows.

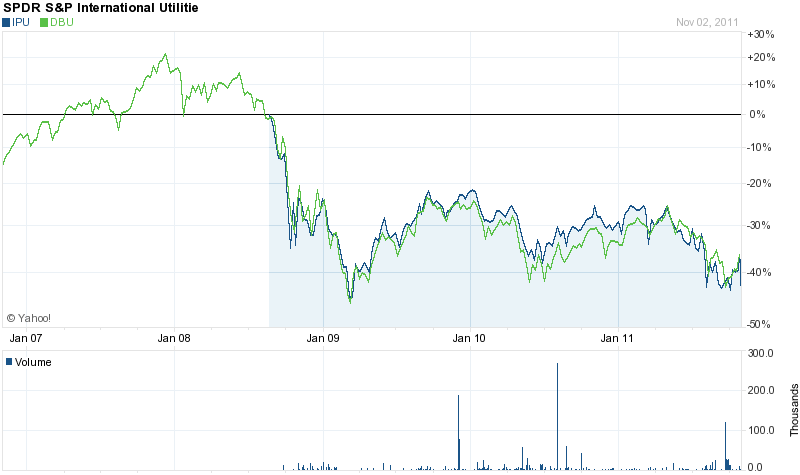

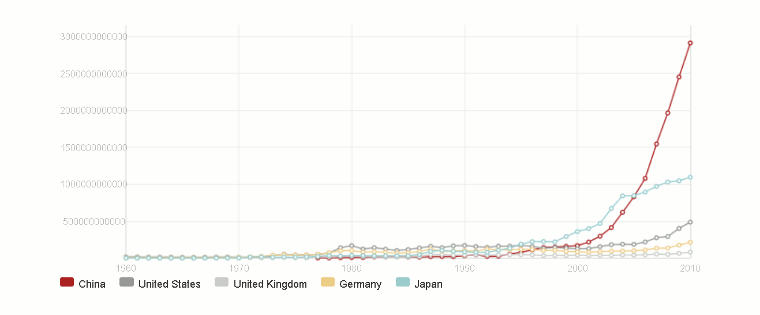

The following chart shows the relative performance of SPDR S&P International Utilities Sector ETF (IPU) and WisdomTree Global ex-US Utilities ETF (DBU):

Click to enlarge

Both these ETFs offer easy access to invest in foreign utilities with the WidsomTree and SPDR funds currently having dividend yields of 4.91% and 5.34% respectively.

nvestors looking to invest directly in individual foreign utilities trading on the organized exchanges have a only few options available. But many more companies trade on the OTC markets. The following is a list of ten foreign utility ADRs trading under $10 for further review:

1.Company: Empresa Distribuidora Y Comerci (EDN)

Current Price: $8.20

Current Dividend Yield: N/A

Country: Argentina

2.Company: Enel Spa (ENLAY)

Current Price: $4.46

Current Dividend Yield: 6.00%

Country: Italy

3.Company: Electricite de France SA (ECIFY)

Current Price: $5.75

Current Dividend Yield: 5.61%

Country: France

4.Company: Verbund (OEZVY)

Current Price: $5.71

Current Dividend Yield: 2.69%

Country: Austria

5.Company: SNAM Rete Gas SpA (SNMRY)

Current Price: $9.22

Current Dividend Yield: 2.69%

Country: Italy

6.Company: Red Electrica (RDEIY)

Current Price: $9.28

Current Dividend Yield: 8.30%

Country: Spain

7.Company: Gas Natural (GASNY)

Current Price: $3.35

Current Dividend Yield: N/A

Country: Spain

8.Company: EVN AG (EVNVY)

Current Price: $3.00

Current Dividend Yield: 3.85%

Country: Austria

9.Company: Fortum Oyj (FOJCY)

Current Price: $4.67

Current Dividend Yield: $6.19%

Country: Finland

10.Company: Centrais Eletricas Brasileiras-Eletrobras (EBR)

Current Price: $9.90

Current Dividend Yield: N/A

Country: Brazil

Note: Prices and Dividend Yields changes noted are as of market close Nov 2, 2011.

Disclosure: No Positions