I came across an interesting article titled “Century of China” is at hand by Berlin Irishev in The Asset magazine of Hong Kong.

From the article:

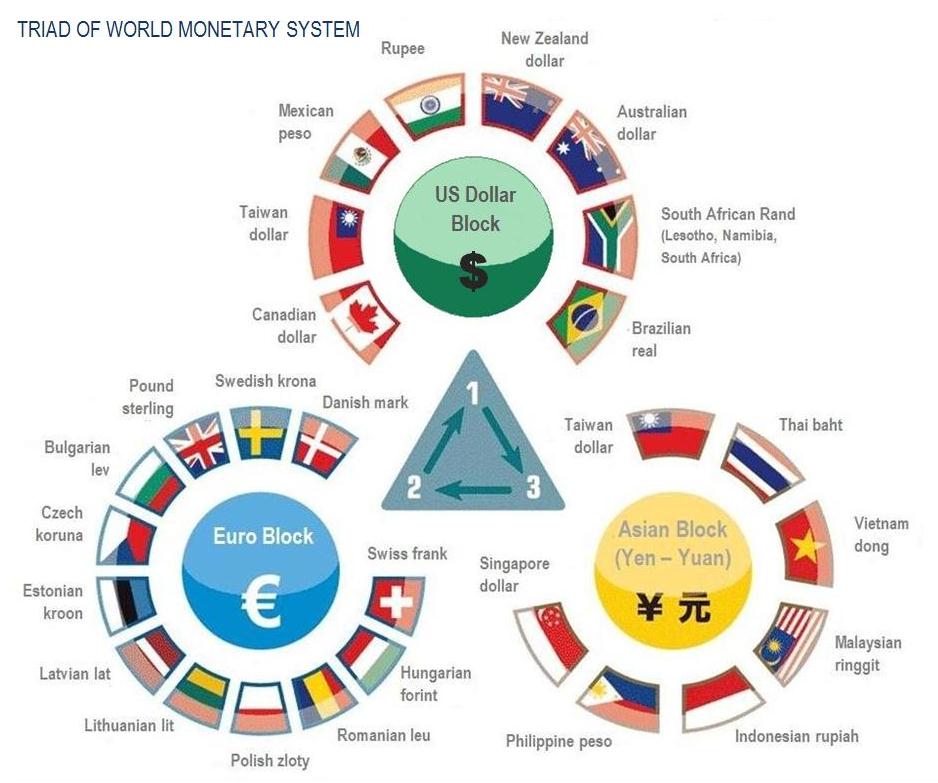

If two vertices of the triangle are represented by the USD and the euro, the third one is Asian, represented by the Chinese yuan/renminbi and the Japanese yen. The value of the monetary triad is that it expresses the real balance of economic powers represented by national or supranational (euro) currencies. It shows evolution since the top vertex can periodically change. The ambiguousness of this triad is that one of its vertices is represented by the Asian camp, where the Chinese currency – the yuan/renminbi – is dominant today. As far back as 2009, it did not have any characteristics of an international currency: it was inconvertible and was not part of the SDR (special drawing rights) – the International Monetary Fund’s basket of currencies, as the Chinese monetary data was deemed not transparent enough and the yuan/renminbi was not considered by the international community. The Chinese economy was not granted market economy status then, and the policy of China’s central bank was questioned by the West. Such resistance from countries with the world’s leading currencies caused a situation of strain, leading to what is dubbed the “international currency war”, at the beginning of 2011.

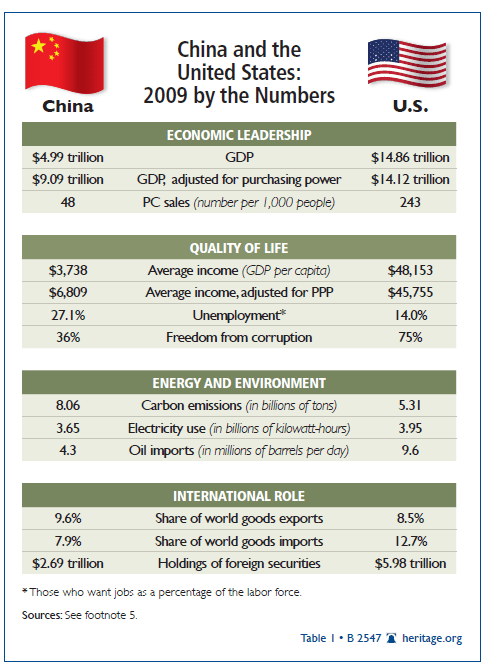

The main argument in favour of the Chinese currency is that the pace of China’s economic growth is above that of other economies. Within the next 10 years, the Chinese GDP will surpass the US, and China will inevitably become the world’s leading economic power. Even today, China holds currency reserves of over USD3.2 trillion, which allows the country to pursue an expansionist policy on a global basis. There is no country in the world that could equal China in investment volume, approaching USD400 billion from USD371 billion in 2010. We could very well be approaching “the century of China.”