Emerging market equities did not perform well last year compared to years before. For example, the the benchmark indices of BRIC countries were down by double digits in 2011 with India’s Sensex being the worst performer losing 24.5%. Russia’s RTS, Brazil’s Bovespa and the Shanghai Composite Index were off 22.0%, 18.1% and 21.7% respectively.

One of the factors that affect the stock market performance of these countries is foreign direct investment(FDI). While theoretically higher FDI should lead to increased economic growth, which in turn can lead to higher stock prices. However this does not happen in the real world. Stocks in emerging markets rise and fall based on many factors including the flow of foreign portfolio capital which can change direction almost overnight.

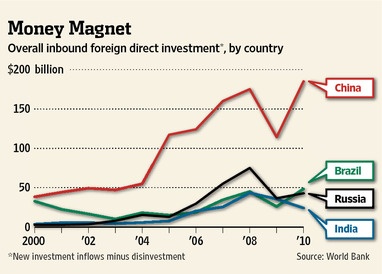

The following chart shows the comparison of FDI among BRICs since 2000:

Source: China Shifts Foreign-Investment Focus, The Wall Street Journal

Due to its large manufacturing base China is the largest recipient of FDI for many years now with India being the recipient of the lowest FDI.

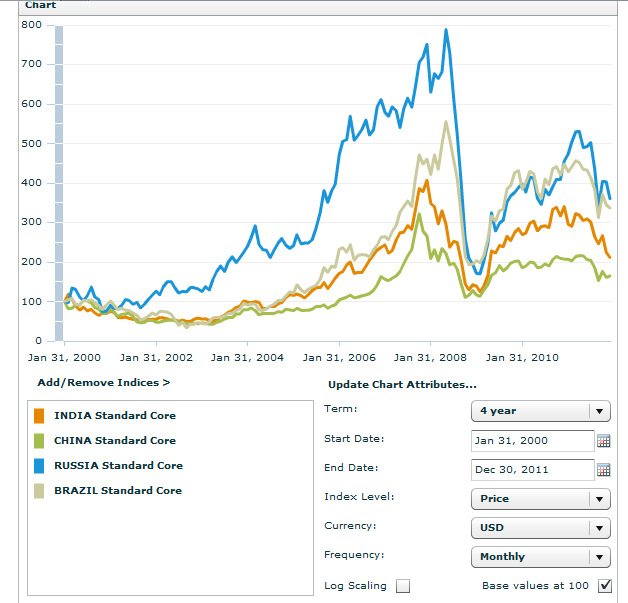

However despite receiving the highest foreign direct investment, Chinese equities have not yielded the highest return to investors as shown in the graph below:

Click to enlarge

Source: MSCI

In the period shown, the Russian equity market has outperformed the equity markets of the other three countries followed by Brazil based on the MSCI index. China was the worst performer with returns that were even lower than that of India’s. So the takeaway from this post is that higher FDI does not necessarily mean higher equity returns.

Related ETFs:

iShares MSCI Brazil Index (EWZ)

Market Vectors Russia ETF (RSX)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

iShares S&P India Nifty 50 (INDY)

Disclosure: No Positions