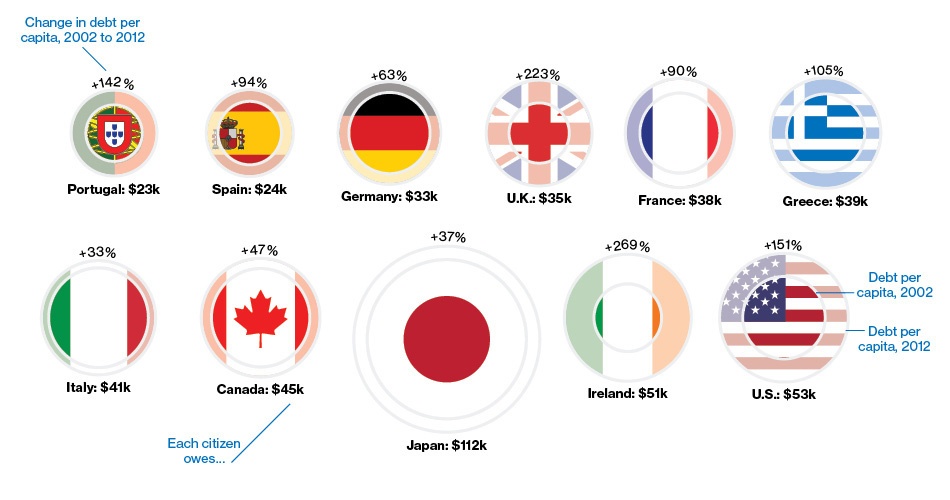

Debt held by governments across the world has increased in the past few years. Some countries in the developed world have seen their total outstanding debt soar due to the recent global financial crisis and the ensuing recession.

Change in debt per capita and debt per capita for select developed countries:

Click to enlarge

Source: An IOU for Every Man, Woman, and Child, Bloomberg BusinessWeek

The total public debt outstanding for the U.S. is about $16.0 Trillion. Out of this the debt held by the public is about $11.2 Trillion with the rest being intragovernmental holdings. Foreigners own about $5.3 Trillion of U.S. debt as of July, 2012.

Unlike the U.S. and major European countries, most of the debt of Japanese government is owned by citizens of Japan. Japanese have one of the highest personal savings rate in the world and hence the high per capita debt is not a major issue.

From an NBC News article:

Japan’s debt-to-GDP ratio of 233.1 percent is the highest among the world’s developed nations by a large margin. Despite the country’s massive debt, it has managed to avoid the type of economic distress affecting nations such as Greece and Portugal. This is largely due to Japan’s healthy unemployment rate and population of domestic bondholders, who consistently fund Japanese government borrowing. Japanese vice minister Fumihiko Igarashi said in a speech in November 2011 that “95 percent of Japanese government bonds have been financed domestically so far, with only 5 percent held by foreigners.” Prime Minister Yoshihiko Noda has proposed the doubling of Japan’s 5 percent national sales tax by 2015 to help bring down the nation’s debt.