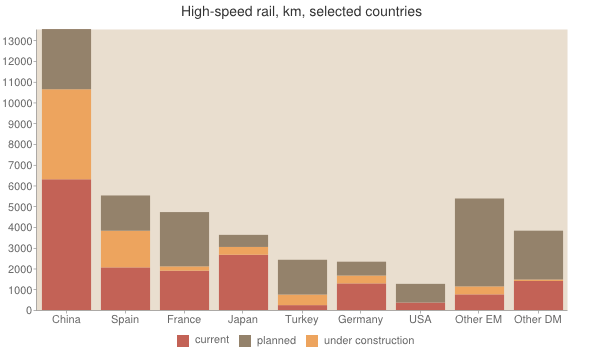

- Is Germany’s big export surplus a problem? (Deutsche Welle)

- Stuck in low global growth and India overtaking China – is this the ‘new normal’ (The Guardian)

- US Equities outlook – Where do we go from here? (Money Observer)

- Europe turning the corner (Fidelity)

- Mastering Global Diversification: What the Masters Tells Us About the Markets (Charles Schwab)

- Should emerging markets worry about the Fed? (Fidelity UK)

- What to buy if you want a growing source of income from UK equities (FE Trustnet)

- Exports, offshoring and pay: New French evidence (Vox)

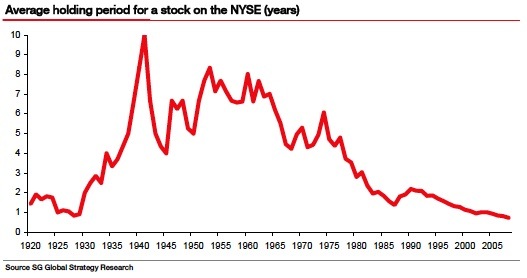

- Buybacks Are Not Just an Accounting Trick (AB Blog)

- Why U.S. Investors are Seeking Opportunities Overseas (Blackrock Blog)

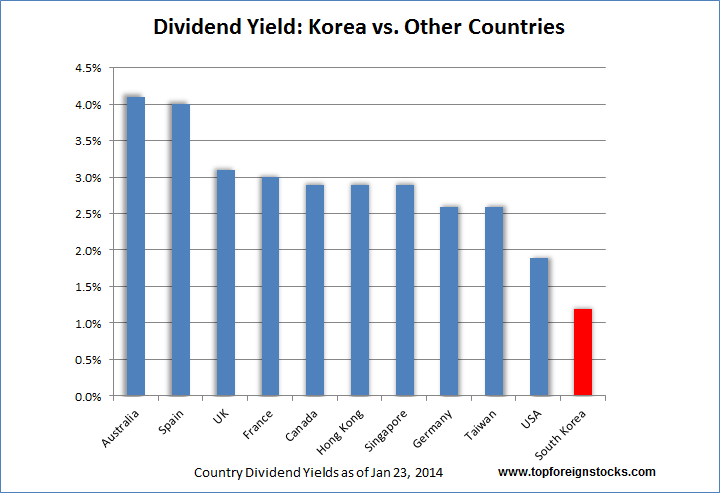

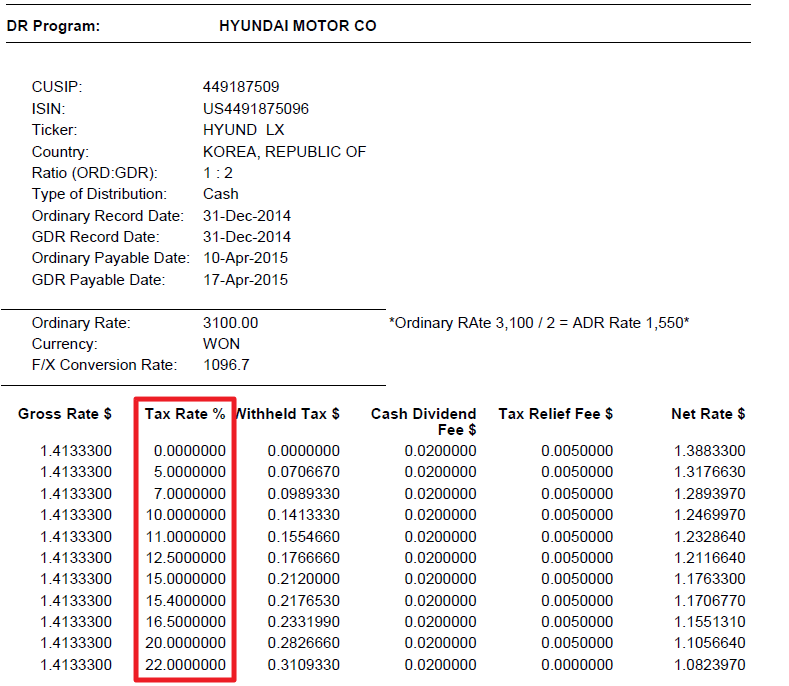

- Korea’s Kospi Smashes Three-Year Ceiling as Foreigners Pile In (Bloomberg)

Click to enlarge

At a farm in UK