On January 26th of this year I wrote an article discussing the stock split of Brazilian water and sewage services utility Companhia de Saneamento Basico do Estado de Sao Paulo also known as SABESP (SBS). After an incredible run in 2012, the stock was split in the ratio of 2:1 on January 24th. After the split, SBS opened at $44.31 on that day and closed at $44.62.

Since the split in January, the stock has mostly remained stable and reached a high of $49.05 in March. However unlike the last time when the stock was split when the price hit over $90.00 , this time the stock was split into 3 for 1 on Apr 30, 2013 when the price was in the low 40s. After closing at $42.06 on April 29th, SBS opened at $14.03 the next day on a split-adjusted basis. Today it closed at $14.31.

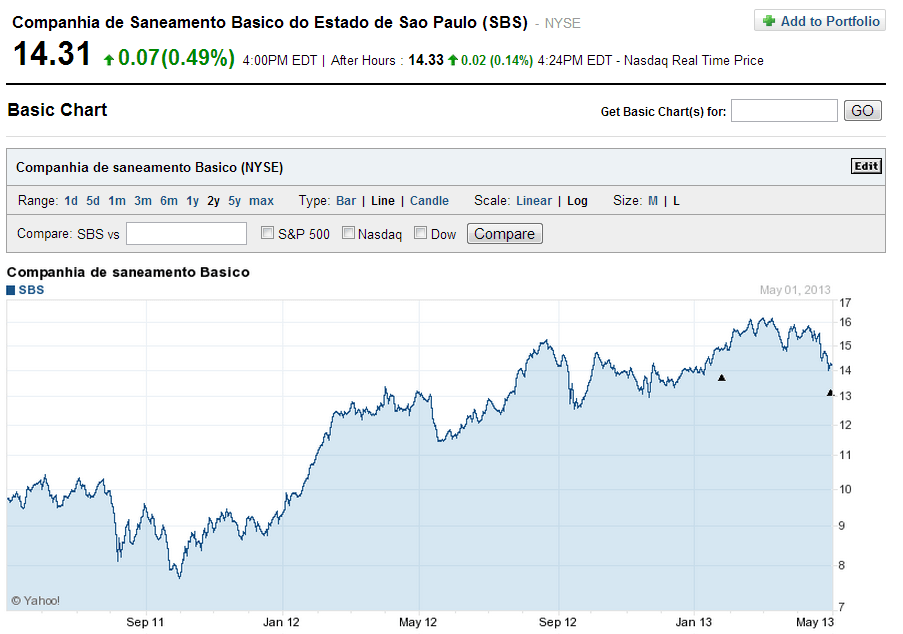

The following chart shows the 2-year returns:

Click to enlarge

Source: Yahoo Finance

Currently SABESP has a market cap of $9.80 Billion and a dividend yield of 2.27%.

Disclosure: No Positions