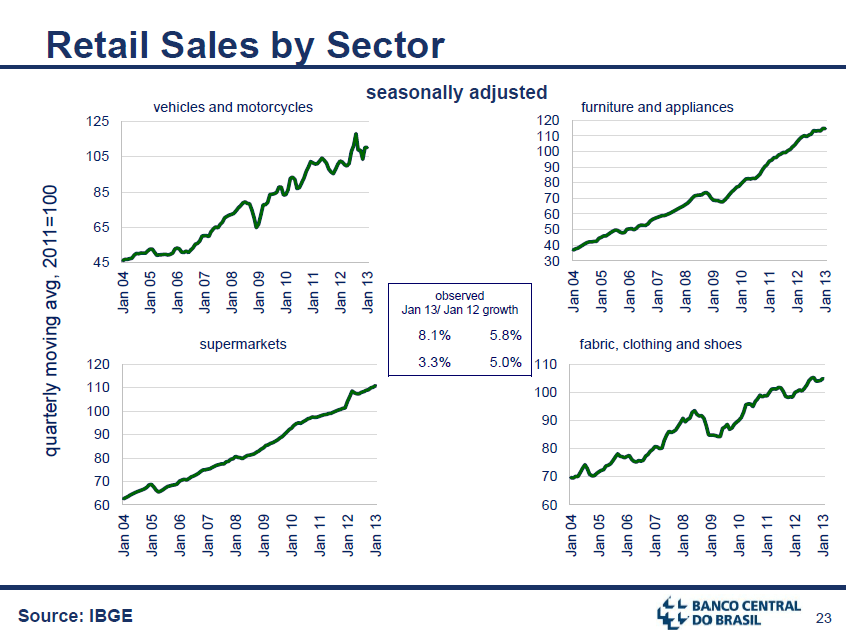

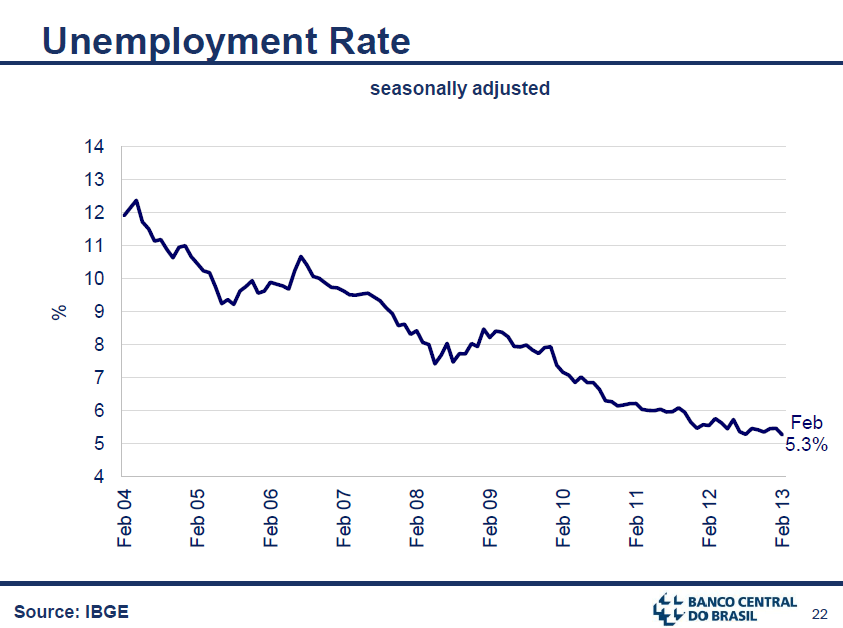

The consumer sector is growing strongly in many emerging countries. The explosive growth in the middle class coupled with rising income levels is fueling the sales of consumer goods. Countries such as Indonesia, India, Turkey, China, Brazil and even Russia are undergoing a major shift in the economy where the consumer is taking the center stage. Until recently most of these countries primarily considered as commodity producers or cheap locations for manufacturing. However that is the not the case anymore as these countries transition to consumption-based economies. China is one classic example where consumption of goods and services is increasing. For example, China is now the largest auto market in the world. The Brazilian retail sector has experienced tremendous growth during president Lula da Silva’s administration and continues to grow under the current leadership.

A recent article in Fidelity Viewpoints discussed about the Chinese economy’s transition from investment-led to consumption-driven and some emerging market consumer stock picks. From the article:

In 2000, China produced about 10 million tons of steel each month. Last year, that number had grown to more that 60 million tons—a six-fold increase in a little more than a decade. The growth was dramatic, but it was also just one small example of how infrastructure construction drove demand for raw materials and helped shape the investment landscape in emerging markets during the last decade.

But a massive shift is underway in China that could change that investment calculus. With many of the highways, skyscrapers, and ports now built, China is trying to navigate a shift from an infrastructure-led economy to a consumer-driven one. Add to that rising wages, and emerging-market investors may benefit by shifting focus from commodities to consumers.

Source: Can consumer stocks lead?, Fidelity Viewpoints, 5/8/13

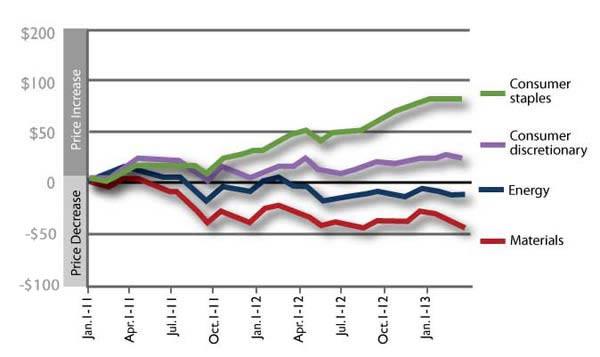

As China moves to a consumption-based economy with much of the basic infrastructure already built the demand for commodities will decline. The Fidelity article noted that energy and materials make up more than 23% of the MSCI Emerging Markets Index. However these two sectors have been laggards in recent years relative to consumer staples and consumer discretionary sectors as shown in the chart below:

Click to enlarge

Some of the ways to profit from the growth in emerging market consumer sector are: invest directly in domestic companies operating in the sector, invest in Western multinationals which have a big presence in these countries with popular brands, invest via ETFs that focus on this sector, etc. For investors who prefer to invest via individual stocks, the best option is go with developed stocks with high exposure to emerging markets. This way investors can avoid issues related to emerging companies such as accounting, lack of transparency, government ownership and control, majority ownership by powerful dynastic families all too common in these countries, etc.

Ten Western multinationals with high exposure to emerging market consumer sector are listed below for consideration:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.12%

Sector: Food Products

Country: Switzerland

2.Company: Unilever PLC (UL)

Current Dividend Yield: 3.02%

Sector: Food Products

Country: UK

3.Company:Colgate-Palmolive Co (CL)

Current Dividend Yield: 2.25%

Sector: Household Products

Country: USA

4.Company:Procter & Gamble Co (PG)

Current Dividend Yield: 3.05%

Sector: Household Products

Country: USA

5.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 3.70%

Sector:Tobacco

Country: UK

6.Company: adidas AG (ADDYY)

Current Dividend Yield: 1.63%

Sector:Textiles, Apparel & Luxury Goods

Country: Germany

7.Company: The Coca-Cola Co (KO)

Current Dividend Yield: 2.66%

Sector:Beverages

Country: USA

8.Company: Henkel AG & Co KGaA (HENKY)

Current Dividend Yield: 1.48%

Sector: Household Products

Country: Germany

9.Company: Heineken NV (HEINY)

Current Dividend Yield:

Sector:Beverages

Country: The Netherlands

10.Company:SABMiller PLC (SABMY)

Current Dividend Yield: 0.81%

Sector:Beverages

Country: UK

Related ETFs:

Note: Dividend yields noted are as of May 10, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions

Disclosure: Long HENKY