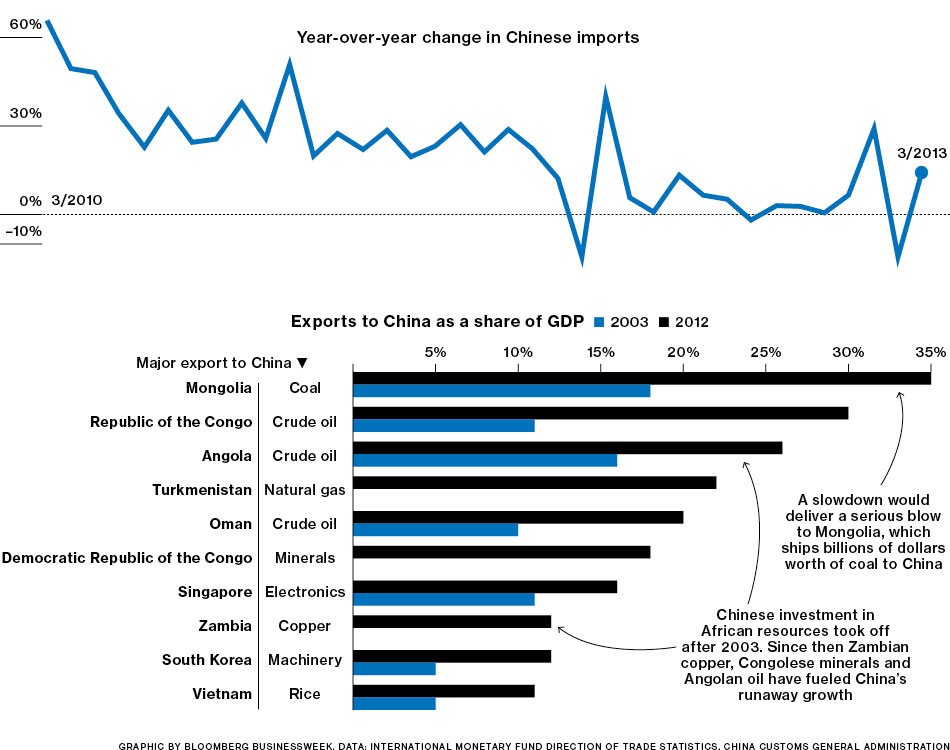

Last December I wrote an article about the countries that are vulnerable due to a slowdown in the Chinese economy. The latest edition of Bloomberg BusinessWeek has a short article discussing the same topic:

Click to enlarge

Source: Bloomberg BusinessWeek

It is interesting that the tiny city state of Singapore appears in the above list. Though the country does not any natural resources that China needs, it is a major manufacturing center for electronic goods. It is also a main trading hub due its port and location.