- Fangs and Nifty Nine power US equities (FT)

- Confessions of a financial crisis junkie: How I learned to stop worrying about the past (Financial Post)

- Student Debt in America: Lend With a Smile, Collect With a Fist (NYT)

- Making lemonade: Tax-loss harvesting (Vanguard Advisors Blog)

- Top 20 generics companies by 2014 revenue (Fierce Pharma)

- Understanding the Two Chinas (AB Blog)

- Russia’s importance for Turkey’s economy(Deutsche Welle)

- Entitlement Reform Is Necessary to Rein in Spending and Debt (The Heritage Foundation)

- Not Every Holding Should Go Up (Random Roger)

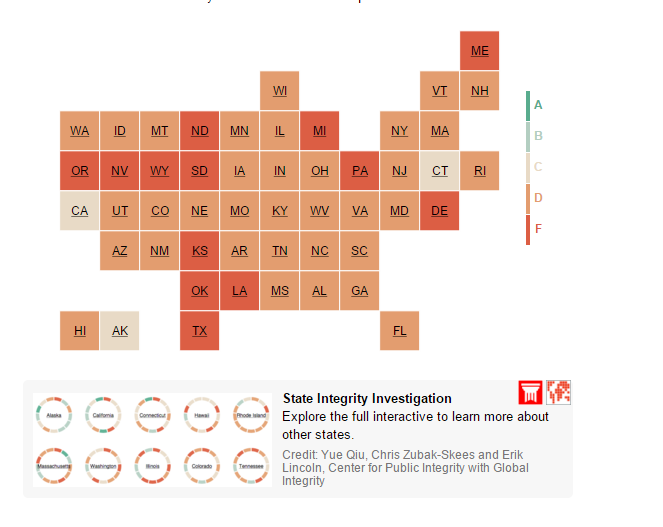

Click to enlarge

Kremlin Palace Hotel, Antalya, Turkey

Photo courtesy of: Deutsche Welle